Trading Oil For Gold and Leaving $US Out In The Cold

Below is a very instructive article first published in Russian by Dmitry Kalinichenko. This translated version by Kristina Rus was found at Fort Russ. I have copied it below in full but I urge readers to follow the link to Fort Russ to read this and other excellent articles.

| Grandmaster Putin's Golden Trap

by Dmitry Kalinichenko for Investcafe.ru Accusations of the West towards Putin traditionally are based on the fact that he worked in the KGB. And therefore he is a cruel and immoral person. Putin is blamed for everything. But nobody ever accused Putin of lack of intelligence. Any accusations against this man only emphasize his ability for quick analytical thinking and making clear and balanced political and economic decisions. Often Western media compares this ability with the ability of a grandmaster, conducting a public chess simul. Recent developments in US economy and the West in general allow us to conclude that in this part of the assessment of Putin's personality Western media is absolutely right. Despite numerous success reports in the style of Fox News and CNN, today, Western economy, led by the United States is in Putin's trap, the way out of which no one in the West can see or find. And the more the West is trying to escape from this trap, the more stuck it becomes. What is the truly tragic predicament of the West and the United States, in which they find themselves? And why all the Western media and leading Western economists are silent about this, as a well guarded military secret? Let's try to understand the essence of current economic events, in the context of the economy, setting aside the factors of morality, ethics and geopolitics. After realizing its failure in Ukraine, the West, led by the US set out to destroy Russian economy by lowering oil prices, and accordingly gas prices as the main budget sources of export revenue in Russia and the main sources of replenishment of Russian gold reserves. It should be noted that the main failure of the West in Ukraine is not military or political. But in the actual refusal of Putin to fund the Western project of Ukraine at the expense of the budget of Russian Federation. What makes this Western project not viable in the near and inevitable future. Last time under president Reagan, such actions of the West's lowering of oil prices led to 'success' and the collapse of USSR. But history does not repeat itself all the time. This time things are different for the West. Putin's response to the West resembles both chess and judo, when the strength used by the enemy is used against him, but with minimal costs to the strength and resources of the defender. Putin's real policies are not public. Therefore, Putin's policy largely has always focused not so much on effect, but on efficiency. Very few people understand what Putin is doing at the moment. And almost no one understands what he will do in the future. No matter how strange it may seem, but right now, Putin is selling Russian oil and gas only for physical gold. Putin is not shouting about it all over the world. And of course, he still accepts US dollars as an intermediate means of payment. But he immediately exchanges all these dollars obtained from the sale of oil and gas for physical gold! To understand this, it is enough to look at the dynamics of growth of gold reserves of Russia and to compare this data with foreign exchange earnings of the RF coming from the sale of oil and gas over the same period.

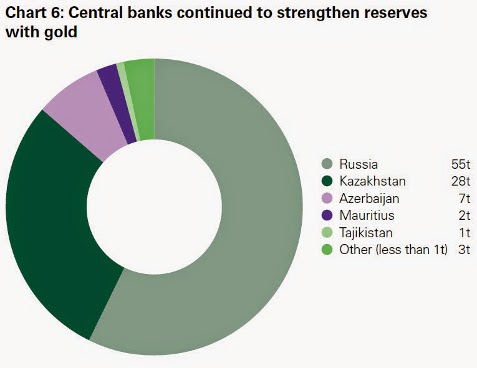

Moreover, in the third quarter the purchases by Russia of physical gold are at an all-time high, record levels. In the third quarter of this year, Russia had purchased an incredible amount of gold in the amount of 55 tons. It's more than all the central banks of all countries of the world combined (according to official data)! In total, the central banks of all countries of the world have purchased 93 tons of the precious metal in the third quarter of 2014. It was the 15th consecutive quarter of net purchases of gold by Central banks. Of the 93 tonnes of gold purchases by central banks around the world during this period, the staggering volume of purchases - of 55 tons - belongs to Russia. Not so long ago, British scientists have successfully come to the same conclusion, as was published in the Conclusion of the U.S. Geological survey a few years ago. Namely: Europe will not be able to survive without energy supply from Russia. Translated from English to any other language in the world it means: "The world will not be able to survive if oil and gas from Russia is subtracted from the global balance of energy supply". Thus, the Western world, built on the hegemony of the petrodollar, is in a catastrophic situation. In which it cannot survive without oil and gas supplies from Russia. And Russia is now ready to sell its oil and gas to the West only in exchange for physical gold! The twist of Putin's game is that the mechanism for the sale of Russian energy to the West only for gold now works regardless of whether the West agrees to pay for Russian oil and gas with its artificially cheap gold, or not. Because Russia, having a regular flow of dollars from the sale of oil and gas, in any case, will be able to convert them to gold with current gold prices, depressed by all means by the West. That is, at the price of gold, which had been artificially and meticulously lowered by the Fed and ESF many times, against artificially inflated purchasing power of the dollar through market manipulation. Interesting fact: the suppression of gold prices by the special department of US Government - ESF (Exchange Stabilization Fund) - with the aim of stabilizing the dollar has been made into a law in the United States. In the financial world it is accepted as a given that gold is an antidollar. In 1971, US President Richard Nixon closed the 'gold window', ending the free exchange of dollars for gold, guaranteed by the US in 1944 at Bretton Woods. Right now the West spends much of its efforts and resources to suppress the prices of gold and oil. Thereby, on the one hand to distort the existing economic reality in favor of the US dollar and on the other hand, to destroy the Russian economy, refusing to play the role of obedient vassal of the West. Today assets such as gold and oil look proportionally weakened and excessively undervalued against the US dollar. It is a consequence of the enormous economic effort on the part of the West. And now Putin sells Russian energy resources in exchange for these US dollars, artificially propped by the efforts of the West. With which he immediately buys gold, artificially devalued against the U.S. dollar by the efforts of the West itself! There is another interesting element in Putin's game. It's Russian uranium. Every sixth light bulb in the USA depends on its supply. Which Russia sells to the US too, for dollars. Thus, in exchange for Russian oil, gas and uranium, the West pays Russia with dollars, purchasing power of which is artificially inflated against oil and gold by the efforts of the West. But Putin uses these dollars only to withdraw physical gold from the West in exchange, for the price denominated in US dollars, artificially lowered by the same West. This truly brilliant economic combination by Putin puts the West led by the United States in a position of a snake, aggressively and diligently devouring its own tail. The idea of this economic golden trap for the West, probably originated not from Putin himself. Most likely it was the idea of Putin's Advisor for Economic Affairs - doctor Sergey Glazyev. Otherwise why seemingly not involved in business bureaucrat Glazyev, along with many Russian businessmen, was personally included by Washington on the sanction list? The idea of an economist, doctor Glazyev was brilliantly executed by Putin, with full endorsement from his Chinese colleague - XI Jinping.

Especially interesting in this context looks the November statement of the first Deputy Chairman of Central Bank of Russia Ksenia Yudaeva, which stressed that the CBR can use the gold from its reserves to pay for imports, if need be. It is obvious that in terms of sanctions by the Western world, this statement is addressed to the BRICS countries, and first of all China. For China, Russia's willingness to pay for goods with Western gold is very convenient. And here's why: China recently announced that it will cease to increase its gold and currency reserves denominated in US dollars. Considering the growing trade deficit between the US and China (the current difference is five times in favor of China), then this statement translated from the financial language reads: "China stops selling their goods for dollars". The world's media chose not to notice this grandest in the recent monetary history event . The issue is not that China literally refuses to sell its goods for US dollars. China, of course, will continue to accept US dollars as an intermediate means of payment for its goods. But, having taken dollars, China will immediately get rid of them and replace with something else in the structure of its gold and currency reserves. Otherwise the statement made by the monetary authorities of China loses its meaning: "We are stopping the increase of our gold and currency reserves, denominated in US dollars." That is, China will no longer buy United States Treasury bonds for dollars earned from trade with any countries, as they did this before. Thus, China will replace all the dollars that it will receive for its goods not only from the US but from all over the world with something else not to increase their gold currency reserves, denominated in US dollars. And here is an interesting question: what will China replace all the trade dollars with? What currency or an asset? Analysis of the current monetary policy of China shows that most likely the dollars coming from trade, or a substantial chunk of them, China will quietly replace and de facto is already replacing with Gold. In this aspect, the solitaire of Russian-Chinese relations is extremely successful for Moscow and Beijing. Russia buys goods from China directly for gold at its current price. While China buys Russian energy resources for gold at its current price. At this Russian-Chinese festival of life there is a place for everything: Chinese goods, Russian energy resources, and gold - as a means of mutual payment. Only US dollar has no place at this festival of life. And this is not surprising. Because the US dollar is not a Chinese product, nor a Russian energy resource. It is only an intermediate financial instrument of settlement - and an unnecessary intermediary. And it is customary to exclude unnecessary intermediaries from the interaction of two independent business partners. It should be noted separately that the global market for physical gold is extremely small relative to the world market for physical oil supplies. And especially the world market for physical gold is microscopic compared to the entirety of world markets for physical delivery of oil, gas, uranium and goods. Emphasis on the phrase "physical gold" is made because in exchange for its physical, not 'paper' energy resources, Russia is now withdrawing gold from the West, but only in its physical, not paper form. So does China, by acquiring from the West the artificially devalued physical gold as a payment for physical delivery of real products to the West. The West's hopes that Russia and China will accept as payment for their energy resources and goods "shitcoin" or so-called "paper gold" of various kinds also did not materialize. Russia and China are only interested in gold and only physical metal as a final means of payment. For reference: the turnover of the market of paper gold, only of gold futures, is estimated at $360 billion per month. But physical delivery of gold is only for $280 million a month. Which makes the ratio of trade of paper gold versus physical gold: 1000 to 1. Using the mechanism of active withdrawal from the market of one artificially lowered by the West financial asset (gold) in exchange for another artificially inflated by the West financial asset (USD), Putin has thereby started the countdown to the end of the world hegemony of petrodollar. Thus, Putin has put the West in a deadlock of the absence of any positive economic prospects. The West can spend as much of its efforts and resources to artificially increase the purchasing power of the dollar, lower oil prices and artificially lower the purchasing power of gold. The problem of the West is that the stocks of physical gold in possession of the West are not unlimited. Therefore, the more the West devalues oil and gold against the US dollar, the faster it loses devaluing Gold from its not infinite reserves. In this brilliantly played by Putin economic combination the physical gold is rapidly flowing to Russia, China, Brazil, Kazakhstan and India, the BRICS countries, from the reserves of the West. At the current rate of reduction of reserves of physical gold, the West simply does not have the time to do anything against Putin's Russia until the collapse of the entire Western petrodollar world. In chess the situation in which Putin has put the West, led by the US, is called "time trouble". The Western world has never faced such economic events and phenomena that are happening right now. USSR rapidly sold gold during the fall of oil prices. Russia rapidly buys gold during the fall in oil prices. Thus, Russia poses a real threat to the American model of petrodollar world domination. The main principle of world petrodollar model is allowing Western countries led by the United States to live at the expense of the labor and resources of other countries and peoples based on the role of the US currency, dominant in the global monetary system (GMS) . The role of the US dollar in the GMS is that it is the ultimate means of payment. This means that the national currency of the United States in the structure of the GMS is the ultimate asset accumulator, to exchange which to any other asset does not make sense. What the BRICS countries, led by Russia and China, are doing now is actually changing the role and status of the US dollar in the global monetary system. From the ultimate means of payment and asset accumulation, the national currency of the USA, by the joint actions of Moscow and Beijing is turned into only an intermediate means of payment. Intended only to exchange this interim payment for another and the ulimate financial asset - gold. Thus, the US dollar actually loses its role as the ultimate means of payment and asset accumulation, yielding both of those roles to another recognized, denationalized and depoliticized monetary asset - gold. Traditionally, the West has used two methods to eliminate the threat to the hegemony of petrodollar model in the world and the consequent excessive privileges for the West. One of these methods - colored revolutions. The second method, which is usually applied by the West, if the first fails - military aggression and bombing. But in Russia's case both of these methods are either impossible or unacceptable for the West. Because, firstly, the population of Russia, unlike people in many other countries, does not wish to exchange their freedom and the future of their children for Western kielbasa. This is evident from the record ratings of Putin, regularly published by the leading Western rating agencies. Personal friendship of Washington protégé Navalny with Senator McCain played for him and Washington a very negative role. Having learned this fact from the media, 98% of the Russian population now perceive Navalny only as a vassal of Washington and a traitor of Russia's national interests. Therefore Western professionals, who have not yet lost their mind, cannot dream about any color revolution in Russia. As for the second traditional Western way of direct military aggression, Russia is certainly not Yugoslavia, not Iraq or Libya. In any non-nuclear military operation against Russia, on the territory of Russia, the West led by the US is doomed to defeat. And the generals in the Pentagon exercising real leadership of NATO forces are aware of this. Similarly hopeless is a nuclear war against Russia, including the concept of so-called "preventive disarming nuclear strike". NATO is simply not technically able to strike a blow that would completely disarm the nuclear potential of Russia in all its many manifestations. A massive nuclear retaliatory strike on the enemy or a pool of enemies would be inevitable. And its total capacity will be enough for survivors to envy the dead. That is, an exchange of nuclear strikes with a country like Russia is not a solution to the looming problem of the collapse of a petrodollar world. It is in the best case, a final chord and the last point in the history of its existence. In the worst case - a nuclear winter and the demise of all life on the planet, except for the bacteria mutated from radiation. The Western economic establishment can see and understand the essence of the situation. Leading Western economists are certainly aware of the severity of the predicament and hopelessness of the situation the Western world finds itself in, in Putin's economic gold trap. After all, since the Bretton Woods agreements, we all know the Golden rule: "Who has more gold sets the rules." But everyone in the West is silent about it. Silent because no one knows now how to get out of this situation. If you explain to the Western public all the details of the looming economic disaster, the public will ask the supporters of a petrodollar world the most terrible questions, which will sound like this: - How long will the West be able to buy oil and gas from Russia in exchange for physical gold? No one in the west today can answer these seemingly simple questions. And this is called "Checkmate", ladies and gentlemen. The game is over. Translated by Kristina Rus |

NB. From the article- "This truly brilliant economic combination by Putin puts the West led by the United States in a position of a snake, aggressively and diligently devouring its own tail."

Once this picture is understood, one can readily understand, on the one hand, the time constraints that the Empire is under and therefore their rush to make as much mayhem around the world that they can and, on the other hand, the seemingly inexhaustible patience that Putin is displaying.

For another very interesting article from Fort Russ, see The failed Ukrainian blitzkrieg that everyone failed to notice

Comments

thanks very much

It looks like Fort Russ needs a place on our sidebar. Anybody know how to do that?

Fort Russ added to Blogroll

Thanks James and Winter!

And it looks like our software is due for the latest update... hopefully tonight I'll do it.

Putin could deep-six the

Putin could deep-six the American economy within weeks by dumping all those T-bills Russia has and continue to sell oil and NG in any currency except the USD.

But our politicos are so used to beating up 3rd world nations and thumping their chests in Congress showing how tough they are to the other Hill apes that they've redefined stupidity.

Then there's Obama, who couldn't be doing a worse job if he tried, or maybe he is trying, trying to serve his Masters in Tel Aviv and Wall Street, neither of whom give a damn about We the People.

Soft landing

Thanks for your comment, Catman.

I believe the Russians (and the Chinese) have held off dumping US Securities to crash the US economy in order to safeguard their own interests and the interests of their trading partners (other than the US). By aiming for a 'soft landing', the Russians are maintaining the maximum level of world trade and prosperity while still protecting their own sovereignty as much as is possible. Even if I'm right, it's still a judgement call on the part of the Russian and Chinese govts.

However, the Russian govt is not entirely a free agent (completely sovereign) in this matter as it has made commercial agreements with the IMF which the Russian Government is bound by so long as they still agree to be bound by those agreements. It sounds a little circular or even non-nonsensical until you realise that there is at least one faction (known in Russia as 'Liberals") within the Russian power structure that is antithetical to Russian national interests.

One critical condition of this agreement with the IMF is that the Russian Central Bank will limit the issuance of its own currency in proportion to the US securities it holds in foreign reserves. This, I dare say, limits the Russian govt's ability to dump these same securities without damaging itself.

This situation can be changed through Russian legislation and an attempt was made to do so a few weeks ago and failed.

Some months ago, another commenter proposed basically that Nabiullina (the current head of the central bank) was in the pocket of the IMF and I disputed that because she was previously an advisor to Vladimir Putin on his staff and that he had appointed her to the Central Bank of Russia. It followed, for me, that she would be sympathetic at least to Putin's economic vision and would implement his policies.

It turns out that that was not the case and the commenter was right. I have to conclude (unsurprisingly) that there is information I am missing or I have made conclusions based on wrong information. It will be interesting (not to say crucial) to see how this plays out.

You might be interested in the first few Q&A's of this post at Sakers-

http://vineyardsaker.blogspot.com/2014/11/mikhail-khazin-q-with-saker-co...

Post new comment