May 2009

Pathway To Darkness, Part 2: Babar Ahmad and the TSG

Fri, 05/29/2009 - 00:17 — WinterIn March of 2009, Babar Ahmad, who is Officially Described As (ODA) a "UK terror suspect", was awarded £60,000 in damages pertaining to an exceptionally violent arrest which he endured more than years earlier.

You can read the whole piece here and/or comment below.

Shell’s Environmental Devastation in Nigeria

Wed, 05/27/2009 - 00:44 — McJShell’s Environmental Devastation in Nigeria

http://wiwavshell.org/about/shells-environmental-devastation-in-nigeria/

Photo used in this article is courtesy of Ed Kashi

Royal Dutch Shell, plc (Shell) began oil production in the Niger Delta region of Nigeria in 1958 and has a long history of working closely with the Nigerian government to quell popular opposition to its presence in the region. From 1990-1995, Nigerian soldiers, at Shell’s request and with Shell’s assistance and financing, used deadly force and conducted massive, brutal raids against the Ogoni people living in the Niger Delta to repress a growing movement in protest of Shell.

On November 10, 1995, nine Ogoni leaders (the “Ogoni Nine”) were executed by the Nigerian government after being falsely accused of murder and tried by a specially-created military tribunal. Those executed were internationally acclaimed environmental and human rights activist Ken Saro-Wiwa, prominent youth leader John Kpuinen, Dr. Barinem Kiobel, Saturday Doobee, Nordu Eawo, Daniel Gbokoo, Paul Levera, Felix Nuate and Baribor Bera. The detention, trial, and executions of the Ogoni Nine were the result of collusion between Shell and the military government to suppress opposition to Shell’s oil operations in Nigeria. The Center for Constitutional Rights (CCR), EarthRights International (ERI) and other human rights attorneys sued Shell for human rights violations against the Ogoni. The case will go to trial on May 27, 2009 in federal court in New York City.

Environmental devastation

The environmental devastation the oil company has caused to Ogoni lands in the Niger Delta was a primary reason for the Ogoni movement against Shell. In 2006, the Niger Delta Natural Resource Damage Assessment and Restoration Project (an independent team of scientists from Nigeria, the U.K. and the U.S.) characterized the Niger Delta as “one of the world’s most severely petroleum-impacted ecosystems.” Their report noted that the Delta is “one of the 10 most important wetlands and marine ecosystems in the world.

Millions of people depend upon the Delta’s natural resources for survival, including the poor in many other West African countries who rely on the migratory fish from the Delta.” Of the nearly 27 million people living in the Niger Delta, an estimated 75 percent rely on the environment for their livelihood, often farming and fishing for market or subsistence living. Shell’s operations in the Delta have led to the deep impoverishment of the Ogoni people and surrounding communities in the Delta.

Gas flaring

Natural gas is a byproduct of oil drilling. In much of the world, this gas is either used for energy or re-injected into the well. In Nigeria, Shell and other oil companies burn it in a process known as gas flaring. Nigeria flares more gas than any other country but Russia; at least 20 billion cubic meters of gas are burned per year, enough to meet the energy needs of Nigeria and neighboring countries. The gas burned in flares is not the clean natural gas used for heating or cooking; the gas is contaminated with toxic compounds and the flares send huge toxic plumes into the air. The chemicals, which end up in local waterways and fields through soot and precipitation, include carcinogens such as benzene, a deadly chemical that can cause convulsions, chromosomal damage and birth defects. Many of the flares are located adjacent to Niger Delta communities. According to the World Bank, gas flaring in Nigeria, which generates no useful energy, has contributed more greenhouse gases emissions than all other sources in sub-Saharan Africa combined.

The Nigerian government first moved to end gas flaring in 1969 when it ordered corporations to set up infrastructure to utilize associated gas. Shell and other oil companies ignored this order. The Nigerian government passed the Associated Gas Reinjection Act in 1979 that required oil companies to submit a detailed plan for utilizing all gas with an ultimate goal of ending flaring by 1984. Since then, Shell and other companies have continued flaring, choosing to pay a fine rather than clean up their operations. Shell was again ordered to stop flaring in 2005 when Nigeria’s Federal High Court declared gas flaring as a gross violation of the neighboring communities’ human rights. Shell and other oil companies continue to make excuses. As of December 2008, there were over 100 flare sites still operating in Nigeria.

“I and my colleagues are not the only ones on trial… Shell is here on trial and… there is no doubt in my mind that the ecological war that the company has waged in the Delta will be called to question…”

- Ken Saro-Wiwa’s closing statement at the trial of the Ogoni 9

Oil spills

An estimated 1.5 million tons of oil has spilled in the Niger Delta ecosystem over the past 50 years. This amount is equivalent to about one “Exxon Valdez” spill in the Niger Delta each year. Many of the spills have taken place in sensitive habitats for birds, fish and other wildlife, leading to further loss of biodiversity and, in turn, further impoverishment of local communities. The spills pollute local water sources that people depend on for drinking, cooking, bathing, laundering and fishing. They also release dangerous fumes into the air, sometimes rendering villages uninhabitable and causing serious illness for those who are unable to relocate. Many of the oil spills can be attributable to poorly maintained infrastructure such as aging pipelines.

Environmental groups in Nigeria and Europe have filed a lawsuit against Shell in the Netherlands for its history of oil spills and lack of cleanup in Nigeria. According to the Nigerian environmental group involved in the suit, cleanup of oil spills is often very superficial, sometimes involving little more than turning the land so that the oil remains just beneath the surface of the soil.

An estimated 1.5 million tons of oil has spilled in the Niger Delta ecosystem over the past 50 years. This amount is equivalent to about one “Exxon Valdez” spill in the Niger Delta each year.

A pattern of Greenwashing

Despite Shell’s dirty record in Nigeria and elsewhere, the company continues to try to falsely portray itself as “green” in its advertising, a practice known as “greenwashing.” The U.K.’s Advertising Standards Authority (ASA) has found that Shell’s environmental claims violated advertising rules. In 2007, Friends of the Earth filed complaints about a Shell ad featuring an oil refinery emitting flowers that was accompanied by a claim that its carbon dioxide waste was used to grow flowers. The chairman of ASA called it “a ridiculous claim” and Shell was forced to pull the ad. In 2008, the ASA banned Shell’s ad that claimed it was building a “profitable and sustainable future” through its development of the largest oil refinery in the U.S. and its petroleum mining in a Canadian oil sands deposit.

The case against Shell

Beginning in 1996, the Center for Constitutional Rights (CCR), EarthRights International (ERI), Paul Hoffman of Schonbrun, DeSimone, Seplow, Harris & Hoffman and other human rights attorneys have brought a series of cases to hold Shell accountable for human rights violations in Nigeria, including summary execution, crimes against humanity, torture, inhuman treatment and arbitrary arrest and detention. The lawsuits are brought against the Royal Dutch/Shell group and Brian Anderson, the head of its Nigerian operation.

The cases were brought under the Alien Tort Statute, a 1789 statute giving non-U.S. citizens the right to file suits in U.S. courts for international human rights violations, and the Torture Victim Protection Act, which allows individuals to seek damages in the U.S. for torture or extrajudicial killing, regardless of where the violations take place. The cases also allege that Shell violated the Racketeer Influenced and Corrupt Organizations Act (RICO) and violations of New York state law.

Shell has made many attempts to have these cases thrown out of court, which the plaintiffs have defeated. The United States District Court for the Southern District of New York has set a trial date of May 27th, 2009. The plaintiffs eagerly await their day in court to hold the defendants accountable for their injuries and the deaths of loved ones.

Come, Let Us Celebrate The Best Of America, Living And Dead

Mon, 05/25/2009 - 23:50 — WinterLet's all have big parades to honor our professional and patriotic mass murderers, living and dead!

Let us line the streets to watch the psychopaths and fools -- and those who support the psychopaths and fools -- march by.

You may read the whole piece here and/or comment below.

First Principles ... or Why I Cannot Support Barack Obama

Wed, 05/20/2009 - 01:34 — WinterLet us begin with the fact that George Bush and Dick Cheney were never legitimately elected to the Oval Office: not in 2000, and not in 2004.

In the American system, the authority of our government is based on the consent of the governed. This consent was not earned in either "election".

Therefore, the Bush-Cheney administrations of 2001-2009 were illegitimate, and the policies implemented by these illegitimate administrations are themselves illegitimate. Period.

If somebody steals your credit card and you report the theft, you are not responsible for purchases made on that card after it was stolen. We reported the theft in 2000; we screamed about the theft in 2004; but it did us no good at all.

You may read the rest here and/or comment below.

Cheney, Hersh, Iqbal, Bhutto, bin Laden: Who's Dead? Who's Lying? Who Knows?

Tue, 05/19/2009 - 11:28 — WinterDawn published a story yesterday by Anwar Iqbal which today has been retracted. Great.

And I blogged about it. Double-Great.

Unfortunately, I didn't manage to save the original text in its entirety at Winter Parking, as I would normally do with a controversial story ... because Blogger was acting up. More greatness than I can stand.

I've updated the original piece on my blog, which you can see here, if you wish. Comments are welcome below.

~~~

I am still hampered with multiple injuries and quite overloaded this week, but I will do my best to get the "Pathway To Darkness" series rolling as soon as possible.

More apologies for more delays... ;-(

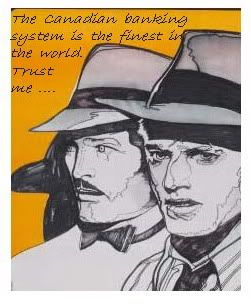

How Not To Fix The Economy

Fri, 05/15/2009 - 20:51 — WinterI haven't read anything like this in a long time...

You may read it here and/or comment below

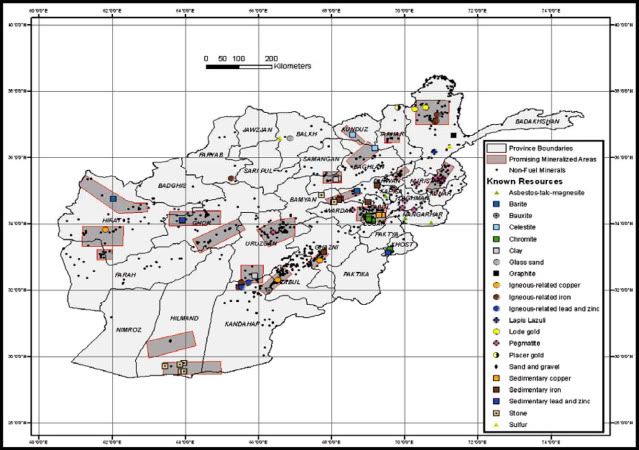

Afghanistan: Known Resources

Thu, 05/14/2009 - 12:44 — McJAfghanistan: Known Resources

http://www.lib.utexas.edu/maps/afghanistan.html

Click here for larger map.

Pipeline-Istan: Everything You Need to Know About Oil, Gas, Russia, China, Iran, Afghanistan and Obama - by Pepe Escobar

Thu, 05/14/2009 - 11:06 — McJPipeline-Istan: Everything You Need to Know About Oil, Gas, Russia, China, Iran, Afghanistan and Obama

by Pepe Escobar

Alternet

Wed, 13 May 2009 16:26 UTC

http://www.alternet.org/audits/139983/pipeline-istan%3A_everything_you_n...

As Barack Obama heads into his second hundred days in office, let's head for the big picture ourselves, the ultimate global plot line, the tumultuous rush towards a new, polycentric world order. In its first hundred days, the Obama presidency introduced us to a brand new acronym, OCO for Overseas Contingency Operations, formerly known as GWOT (as in Global War on Terror). Use either name, or anything else you want, and what you're really talking about is what's happening on the immense energy battlefield that extends from Iran to the Pacific Ocean. It's there that the Liquid War for the control of Eurasia takes place.

Yep, it all comes down to black gold and "blue gold" (natural gas), hydrocarbon wealth beyond compare, and so it's time to trek back to that ever-flowing wonderland -- Pipelineistan. It's time to dust off the acronyms, especially the SCO or Shanghai Cooperative Organization, the Asian response to NATO, and learn a few new ones like IPI and TAPI. Above all, it's time to check out the most recent moves on the giant chessboard of Eurasia, where Washington wants to be a crucial, if not dominant, player.

We've already seen Pipelineistan wars in Kosovo and Georgia, and we've followed Washington's favorite pipeline, the BTC, which was supposed to tilt the flow of energy westward, sending oil coursing past both Iran and Russia. Things didn't quite turn out that way, but we've got to move on, the New Great Game never stops. Now, it's time to grasp just what the Asian Energy Security Grid is all about, visit a surreal natural gas republic, and understand why that Grid is so deeply implicated in the Af-Pak war.

Every time I've visited Iran, energy analysts stress the total "interdependence of Asia and Persian Gulf geo-ecopolitics." What they mean is the ultimate importance to various great and regional powers of Asian integration via a sprawling mass of energy pipelines that will someday, somehow, link the Persian Gulf, Central Asia, South Asia, Russia, and China. The major Iranian card in the Asian integration game is the gigantic South Pars natural gas field (which Iran shares with Qatar). It is estimated to hold at least 9% of the world's proven natural gas reserves.

As much as Washington may live in perpetual denial, Russia and Iran together control roughly 20% of the world's oil reserves and nearly 50% of its gas reserves. Think about that for a moment. It's little wonder that, for the leadership of both countries as well as China's, the idea of Asian integration, of the Grid, is sacrosanct.

If it ever gets built, a major node on that Grid will surely be the prospective $7.6 billion Iran-Pakistan-India (IPI) pipeline, also known as the "peace pipeline." After years of wrangling, a nearly miraculous agreement for its construction was initialed in 2008. At least in this rare case, both Pakistan and India stood shoulder to shoulder in rejecting relentless pressure from the Bush administration to scotch the deal.

It couldn't be otherwise. Pakistan, after all, is an energy-poor, desperate customer of the Grid. One year ago, in a speech at Beijing's Tsinghua University, then-President Pervez Musharraf did everything but drop to his knees and beg China to dump money into pipelines linking the Persian Gulf and Pakistan with China's Far West. If this were to happen, it might help transform Pakistan from a near-failed state into a mighty "energy corridor" to the Middle East. If you think of a pipeline as an umbilical cord, it goes without saying that IPI, far more than any form of U.S. aid (or outright interference), would go the extra mile in stabilizing the Pak half of Obama's Af-Pak theater of operations, and even possibly relieve it of its India obsession.

If Pakistan's fate is in question, Iran's is another matter. Though currently only holding "observer" status in the Shanghai Cooperation Organization (SCO), sooner or later it will inevitably become a full member and so enjoy NATO-style, an-attack-on-one-of-us-is-an-attack-on-all-of-us protection. Imagine, then, the cataclysmic consequences of an Israeli preemptive strike (backed by Washington or not) on Iran's nuclear facilities. The SCO will tackle this knotty issue at its next summit in June, in Yekaterinburg, Russia.

Iran's relations with both Russia and China are swell -- and will remain so no matter who is elected the new Iranian president next month. China desperately needs Iranian oil and gas, has already clinched a $100 billion gas "deal of the century" with the Iranians, and has loads of weapons and cheap consumer goods to sell. No less close to Iran, Russia wants to sell them even more weapons, as well as nuclear energy technology.

And then, moving ever eastward on the great Grid, there's Turkmenistan, lodged deep in Central Asia, which, unlike Iran, you may never have heard a thing about. Let's correct that now.

Gurbanguly Is the Man

Alas, the sun-king of Turkmenistan, the wily, wacky Saparmurat "Turkmenbashi" Nyazov, "the father of all Turkmen" (descendants of a formidable race of nomadic horseback warriors who used to attack Silk Road caravans) is now dead. But far from forgotten.

The Chinese were huge fans of the Turkmenbashi. And the joy was mutual. One key reason the Central Asians love to do business with China is that the Middle Kingdom, unlike both Russia and the United States, carries little modern imperial baggage. And of course, China will never carp about human rights or foment a color-coded revolution of any sort.

The Chinese are already moving to successfully lobby the new Turkmen president, the spectacularly named Gurbanguly Berdymukhamedov, to speed up the construction of the Mother of All Pipelines. This Turkmen-Kazakh-China Pipelineistan corridor from eastern Turkmenistan to China's Guangdong province will be the longest and most expensive pipeline in the world, 7,000 kilometers of steel pipe at a staggering cost of $26 billion. When China signed the agreement to build it in 2007, they made sure to add a clever little geopolitical kicker. The agreement explicitly states that "Chinese interests" will not be "threatened from [Turkmenistan's] territory by third parties." In translation: no Pentagon bases allowed in that country.

China's deft energy diplomacy game plan in the former Soviet republics of Central Asia is a pure winner. In the case of Turkmenistan, lucrative deals are offered and partnerships with Russia are encouraged to boost Turkmen gas production. There are to be no Russian-Chinese antagonisms, as befits the main partners in the SCO, because the Asian Energy Security Grid story is really and truly about them.

By the way, elsewhere on the Grid, those two countries recently agreed to extend the East Siberian-Pacific Ocean oil pipeline to China by the end of 2010. After all, energy-ravenous China badly needs not just Turkmen gas, but Russia's liquefied natural gas (LNG).

With energy prices low and the global economy melting down, times are sure to be tough for the Kremlin through at least 2010, but this won't derail its push to forge a Central Asian energy club within the SCO. Think of all this as essentially an energy entente cordiale with China. Russian Deputy Industry and Energy Minister Ivan Materov has been among those insistently swearing that this will not someday lead to a "gas OPEC" within the SCO. It remains to be seen how the Obama national security team decides to counteract the successful Russian strategy of undermining by all possible means a U.S.-promoted East-West Caspian Sea energy corridor, while solidifying a Russian-controlled Pipelineistan stretching from Kazakhstan to Greece that will monopolize the flow of energy to Western Europe.

The Real Afghan War

In the ever-shifting New Great Game in Eurasia, a key question - why Afghanistan matters - is simply not part of the discussion in the United States. (Hint: It has nothing to do with the liberation of Afghan women.) In part, this is because the idea that energy and Afghanistan might have anything in common is verboten.

And yet, rest assured, nothing of significance takes place in Eurasia without an energy angle. In the case of Afghanistan, keep in mind that Central and South Asia have been considered by American strategists crucial places to plant the flag; and once the Soviet Union collapsed, control of the energy-rich former Soviet republics in the region was quickly seen as essential to future U.S. global power. It would be there, as they imagined it, that the U.S. Empire of Bases would intersect crucially with Pipelineistan in a way that would leave both Russia and China on the defensive.

Think of Afghanistan, then, as an overlooked subplot in the ongoing Liquid War. After all, an overarching goal of U.S. foreign policy since President Richard Nixon's era in the early 1970s has been to split Russia and China. The leadership of the SCO has been focused on this since the U.S. Congress passed the Silk Road Strategy Act five days before beginning the bombing of Serbia in March 1999. That act clearly identified American geo-strategic interests from the Black Sea to western China with building a mosaic of American protectorates in Central Asia and militarizing the Eurasian energy corridor.

Afghanistan, as it happens, sits conveniently at the crossroads of any new Silk Road linking the Caucasus to western China, and four nuclear powers (China, Russia, Pakistan, and India) lurk in the vicinity. "Losing" Afghanistan and its key network of U.S. military bases would, from the Pentagon's point of view, be a disaster, and though it may be a secondary matter in the New Great Game of the moment, it's worth remembering that the country itself is a lot more than the towering mountains of the Hindu Kush and immense deserts: it's believed to be rich in unexplored deposits of natural gas, petroleum, coal, copper, chrome, talc, barites, sulfur, lead, zinc, and iron ore, as well as precious and semiprecious stones.

And there's something highly toxic to be added to this already lethal mix: don't forget the narco-dollar angle - the fact that the global heroin cartels that feast on Afghanistan only work with U.S. dollars, not euros. For the SCO, the top security threat in Afghanistan isn't the Taliban, but the drug business. Russia's anti-drug czar Viktor Ivanov routinely blasts the disaster that passes for a U.S./NATO anti-drug war there, stressing that Afghan heroin now kills 30,000 Russians annually, twice as many as were killed during the decade-long U.S.-supported anti-Soviet Afghan jihad of the 1980s.

And then, of course, there are those competing pipelines that, if ever built, either would or wouldn't exclude Iran and Russia from the action to their south. In April 2008, Turkmenistan, Afghanistan, Pakistan, and India actually signed an agreement to build a long-dreamt-about $7.6 billion (and counting) pipeline, whose acronym TAPI combines the first letters of their names and would also someday deliver natural gas from Turkmenistan to Pakistan and India without the involvement of either Iran or Russia. It would cut right through the heart of Western Afghanistan, in Herat, and head south across lightly populated Nimruz and Helmand provinces, where the Taliban, various Pashtun guerrillas and assorted highway robbers now merrily run rings around U.S. and NATO forces and where - surprise! - the U.S. is now building in Dasht-e-Margo ("the Desert of Death") a new mega-base to host President Obama's surge troops.

TAPI's rival is the already mentioned IPI, also theoretically underway and widely derided by Heritage Foundation types in the U.S., who regularly launch blasts of angry prose at the nefarious idea of India and Pakistan importing gas from "evil" Iran. Theoretically, TAPI's construction will start in 2010 and the gas would begin flowing by 2015. (Don't hold your breath.) Embattled Afghan President Hamid Karzai, who can hardly secure a few square blocks of central Kabul, even with the help of international forces, nonetheless offered assurances last year that he would not only rid his country of millions of land mines along TAPI's route, but somehow get rid of the Taliban in the bargain.

Should there be investors (nursed by Afghan opium dreams) delirious enough to sink their money into such a pipeline - and that's a monumental if - Afghanistan would collect only $160 million a year in transit fees, a mere bagatelle even if it does represent a big chunk of the embattled Karzai's current annual revenue. Count on one thing though, if it ever happened, the Taliban and assorted warlords/highway robbers would be sure to get a cut of the action.

A Clinton-Bush-Obama Great Game

TAPI's roller-coaster history actually begins in the mid-1990s, the Clinton era, when the Taliban were dined (but not wined) by the California-based energy company Unocal and the Clinton machine. In 1995, Unocal first came up with the pipeline idea, even then a product of Washington's fatal urge to bypass both Iran and Russia. Next, Unocal talked to the Turkmenbashi, then to the Taliban, and so launched a classic New Great Game gambit that has yet to end and without which you can't understand the Afghan war Obama has inherited.

A Taliban delegation, thanks to Unocal, enjoyed Houston's hospitality in early 1997 and then Washington's in December of that year. When it came to energy negotiations, the Taliban's leadership was anything but medieval. They were tough bargainers, also cannily courting the Argentinean private oil company Bridas, which had secured the right to explore and exploit oil reserves in eastern Turkmenistan.

In August 1997, financially unstable Bridas sold 60% of its stock to Amoco, which merged the next year with British Petroleum. A key Amoco consultant happened to be that ubiquitous Eurasian player, former national security advisor Zbig Brzezinski, while another such luminary, Henry Kissinger, just happened to be a consultant for Unocal. BP-Amoco, already developing the Baku-Tblisi-Ceyhan (BTC) pipeline, now became the major player in what had already been dubbed the Trans-Afghan Pipeline or TAP. Inevitably, Unocal and BP-Amoco went to war and let the lawyers settle things in a Texas court, where, in October 1998 as the Clinton years drew to an end, BP-Amoco seemed to emerge with the upper hand.

Under newly elected president George W. Bush, however, Unocal snuck back into the game and, as early as January 2001, was cozying up to the Taliban yet again, this time supported by a star-studded governmental cast of characters, including Undersecretary of State Richard Armitage, himself a former Unocal lobbyist. The Taliban were duly invited back to Washington in March 2001 via Rahmatullah Hashimi, a top aide to "The Shadow," the movement's leader Mullah Omar.

Negotiations eventually broke down because of those pesky transit fees the Taliban demanded. Beware the Empire's fury. At a Group of Eight summit meeting in Genoa in July 2001, Western diplomats indicated that the Bush administration had decided to take the Taliban down before year's end. (Pakistani diplomats in Islamabad would later confirm this to me.) The attacks of September 11, 2001 just slightly accelerated the schedule. Nicknamed "the kebab seller" in Kabul, Hamid Karzai, a former CIA asset and Unocal representative, who had entertained visiting Taliban members at barbecues in Houston, was soon forced down Afghan throats as the country's new leader.

Among the first fruits of Donald Rumsfeld's bombing and invasion of Afghanistan in the fall of 2001 was the signing by Karzai, Pakistani President Musharraf and Turkmenistan's Nyazov of an agreement committing themselves to build TAP, and so was formally launched a Pipelineistan extension from Central to South Asia with brand USA stamped all over it.

Russian President Vladimir Putin did nothing - until September 2006, that is, when he delivered his counterpunch with panache. That's when Russian energy behemoth Gazprom agreed to buy Nyazov's natural gas at the 40% mark-up the dictator demanded. In return, the Russians received priceless gifts (and the Bush administration a pricey kick in the face). Nyazov turned over control of Turkmenistan's entire gas surplus to the Russian company through 2009, indicated a preference for letting Russia explore the country's new gas fields, and stated that Turkmenistan was bowing out of any U.S.-backed Trans-Caspian pipeline project. (And while he was at it, Putin also cornered much of the gas exports of Kazakhstan and Uzbekistan as well.)

Thus, almost five years later, with occupied Afghanistan in increasingly deadly chaos, TAP seemed dead-on-arrival. The (invisible) star of what would later turn into Obama's "good" war was already a corpse.

But here's the beauty of Pipelineistan: like zombies, dead deals always seem to return and so the game goes on forever.

Just when Russia thought it had Turkmenistan locked in...

A Turkmen Bash

They don't call Turkmenistan a "gas republic" for nothing. I've crossed it from the Uzbek border to a Caspian Sea port named - what else - Turkmenbashi where you can purchase one kilo of fresh Beluga for $100 and a camel for $200. That's where the gigantic gas fields are, and it's obvious that most have not been fully explored. When, in October 2008, the British consultancy firm GCA confirmed that the Yolotan-Osman gas fields in southwest Turkmenistan were among the world's four largest, holding up to a staggering 14 trillion cubic meters of natural gas, Turkmenistan promptly grabbed second place in the global gas reserves sweepstakes, way ahead of Iran and only 20% below Russia. With that news, the earth shook seismically across Pipelineistan.

Just before he died in December 2006, the flamboyant Turkmenbashi boasted that his country held enough reserves to export 150 billion cubic meters of gas annually for the next 250 years. Given his notorious megalomania, nobody took him seriously. So in March 2008, our man Gurbanguly ordered a GCA audit to dispel any doubts. After all, in pure Asian Energy Security Grid mode, Turkmenistan had already signed contracts to supply Russia with about 50 billion cubic meters annually, China with 40 billion cubic meters, and Iran with 8 billion cubic meters.

And yet, none of this turns out to be quite as monumental or settled as it may look. In fact, Turkmenistan and Russia may be playing the energy equivalent of Russian roulette. After all, virtually all of Turkmenistani gas exports flow north through an old, crumbling Soviet system of pipelines, largely built in the 1960s. Add to this a Turkmeni knack for raising the stakes non-stop at a time when Gazprom has little choice but to put up with it: without Turkmen gas, it simply can't export all it needs to Europe, the source of 70% of Gazprom's profits.

Worse yet, according to a Gazprom source quoted in the Russian business daily Kommersant, the stark fact is that the company only thought it controlled all of Turkmenistan's gas exports; the newly discovered gas mega-fields turn out not to be part of the deal. As my Asia Times colleague, former ambassador M.K. Bhadrakumar put the matter, Gazprom's mistake "is proving to be a misconception of Himalayan proportions."

In fact, it's as if the New Great Gamesters had just discovered another Everest. This year, Obama's national security strategists lost no time unleashing a no-holds-barred diplomatic campaign to court Turkmenistan. The goal? To accelerate possible ways for all that new Turkmeni gas to flow through the right pipes, and create quite a different energy map and future. Apart from TAPI, another key objective is to make the prospective $5.8 billion Turkey-to-Austria Nabucco pipeline become viable and thus, of course, trump the Russians. In that way, a key long-term U.S. strategic objective would be fulfilled: Austria, Italy, and Greece, as well as the Balkan and various Central European countries, would be at least partially pulled from Gazprom's orbit. (Await my next "postcard" from Pipelineistan for more on this.)

IPI or TAPI?

Gurbanguly is proving an even more riotous player than the Turkmenbashi. A year ago he said he was going to hedge his bets, that he was willing to export the bulk of the eight trillion cubic meters of gas reserves he now claims for his country to virtually anyone. Washington was - and remains - ecstatic. At an international conference last month in Ashgabat ("the city of love"), the Las Vegas of Central Asia, Gurbanguly told a hall packed with Americans, Europeans, and Russians that "diversification of energy flows and inclusion of new countries into the geography of export routes can help the global economy gain stability."

Inevitably, behind closed doors, the TAPI maze came up and TAPI executives once again began discussing pricing and transit fees. Of course, hard as that may be to settle, it's the easy part of the deal. After all, there's that Everest of Afghan security to climb, and someone still has to confirm that Turkmenistan's gas reserves are really as fabulous as claimed.

Imperceptible jiggles in Pipelineistan's tectonic plates can shake half the world. Take, for example, an obscure March report in the Balochistan Times: a little noticed pipeline supplying gas to parts of Sindh province in Pakistan, including Karachi, was blown up. It got next to no media attention, but all across Eurasia and in Washington, those analyzing the comparative advantages of TAPI vs. IPI had to wonder just how risky it might be for India to buy future Iranian gas via increasingly volatile Balochistan.

And then in early April came another mysterious pipeline explosion, this one in Turkmenistan, compromising exports to Russia. The Turkmenis promptly blamed the Russians (and TAPI advocates cheered), but nothing in Afghanistan itself could have left them cheering very loudly. Right now, Dick Cheney's master plan to get those blue rivers of Turkmeni gas flowing southwards via a future TAPI as part of a U.S. grand strategy for a "Greater Central Asia" lies in tatters.

Still, Zbig Brzezinski might disagree, and as he commands Obama's attention, he may try to convince the new president that the world needs a $7.6-plus billion, 1,600-km steel serpent winding through a horribly dangerous war zone. That's certainly the gist of what Brzezinski said immediately after the 2008 Russia-Georgia war, stressing once again that "the construction of a pipeline from Central Asia via Afghanistan to the south... will maximally expand world society's access to the Central Asian energy market."

Washington or Beijing?

Still, give credit where it's due. For the time being, our man Gurbanguly may have snatched the leading role in the New Great Game in this part of Eurasia. He's already signed a groundbreaking gas agreement with RWE from Germany and sent the Russians scrambling.

If, one of these days, the Turkmenistani leader opts for TAPI as well, it will open Washington to an ultimate historical irony. After so much death and destruction, Washington would undoubtedly have to sit down once again with - yes - the Taliban! And we'd be back to July 2001 and those pesky pipeline transit fees.

As it stands at the moment, however, Russia still dominates Pipelineistan, ensuring Central Asian gas flows across Russia's network and not through the Trans-Caspian networks privileged by the U.S. and the European Union. This virtually guarantees Russia's crucial geopolitical status as the top gas supplier to Europe and a crucial supplier to Asia as well.

Meanwhile, in "transit corridor" Pakistan, where Predator drones soaring over Pashtun tribal villages monopolize the headlines, the shady New Great Game slouches in under-the-radar mode toward the immense, under-populated southern Pakistani province of Balochistan. The future of the epic IPI vs. TAPI battle may hinge on a single, magic word: Gwadar.

Essentially a fishing village, Gwadar is an Arabian Sea port in that province. The port was built by China. In Washington's dream scenario, Gwadar becomes the new Dubai of South Asia. This implies the success of TAPI. For its part, China badly needs Gwadar as a node for yet another long pipeline to be built to western China. And where would the gas flowing in that line come from? Iran, of course.

Whoever "wins," if Gwadar really becomes part of the Liquid War, Pakistan will finally become a key transit corridor for either Iranian gas from the monster South Pars field heading for China, or a great deal of the Caspian gas from Turkmenistan heading Europe-wards. To make the scenario even more locally mouth-watering, Pakistan would then be a pivotal place for both NATO and the SCO (in which it is already an official "observer").

Now that's as classic as the New Great Game in Eurasia can get. There's NATO vs. the SCO. With either IPI or TAPI, Turkmenistan wins. With either IPI or TAPI, Russia loses. With either IPI or TAPI, Pakistan wins. With TAPI, Iran loses. With IPI, Afghanistan loses. In the end, however, as in any game of high stakes Pipelineistan poker, it all comes down to the top two global players. Ladies and gentlemen, place your bets: will the winner be Washington or Beijing?

Print

More Thoughts About The War Between The USA And Pakistan

Thu, 05/14/2009 - 00:59 — WinterSince I wrote my recent post about the war between the USA and Pakistan, some questions have come up which have put me in mind of a piece I posted about 18 months ago, featuring some very sharp commentary from a young female Pakistani journalist.

In a column published November 4, 2007, the day after emergency rule was declared in Pakistan, and in the midst of a strict political clampdown, Fatima Bhutto honored the restriction against ridiculing the President, General Pervez Musharraf, by not mentioning him at all.

you can read the whole post here and/or comment below

Pathway To Darkness, Part 1: "The Easter Bombers"

Tue, 05/12/2009 - 11:35 — WinterOn April 8, 2009, amid a blaze of publicity, police in the north of England arrested 12 men who were Officially Described As (ODA) "terror suspects".

England's Prime Minister, Gordon Brown, congratulated the police and intelligence agencies on having broken up "a very big plot".

~~~

You can read the rest here and/or comment below.

Thoughts On The War Between The USA And Pakistan

Fri, 05/08/2009 - 14:22 — WinterSigns and omens, suddenly everywhere, tell us war between the USA and Pakistan is imminent. ... The signs are misleading. War between the US and Pakistan is not imminent. It’s ongoing. ... What’s imminent is a grave escalation.

You can read the rest here, and/or comment below.

Sold Out: How Wall Street and Washington Betrayed America - by Robert Weissman & James Donahue

Thu, 05/07/2009 - 13:04 — McJThe following article by Lorimer Wilson is a review of A Consumer Education Foundation Report titled:

" Sold Out: How Wall Street and Washington Betrayed America" by Robert Weissman & James Donahue.

I have embedded the 231 page report (hosted at scribd) below this review by Lorimer.

America: 'Sold Out' for $5.2 Billion Lorimer Wilson May 5, 2009 http://www.321gold.com/editorials/wilson/wilson050509.html This article is a follow-up to my recent piece on "America's Financial Oligarchy" [read at Kitco] which was a synopsis of Simon Johnson's "The Quiet Coup" on how the financial industry has effectively captured our government. It is an edit and review of a lengthy 231-page report prepared in March 2009 by the Consumer Education Foundation on how, over the years, the 'Money Industry' as they refer to the financial oligarchy, sold out America to gain such control. Like Simon's article the Consumer Education report deserves much more exposure than it will receive in its original format and hence my effort to distill it into a 3-page summary, with my comments where warranted, for your quick review. ========================================================================= The 'Money Industry' Bought Control of America for $5.2 Billion Harvey Rosenfield, President of the Consumer Education Foundation, contends that "Over the last decade, Wall Street (i.e. the entire financial sector consisting of commercial banks, accounting firms, insurance companies, securities firms including hedge funds and private equity firms) showered Washington with over $1.738 billion in supposed 'campaign contributions' and another $3.441 billion on 2,996 officially registered lobbyists (more than five for each Member of Congress) whose job it was to press for deregulation. In return for the investment of this $5.179 billion, the Money Industry was able to get rid of many of the reforms enacted after the Great Depression and to operate, for most of the last ten years, without any effective rules or restraints whatsoever." The Transfer of Power Took 25 Years * Beginning in 1983 with the Reagan Administration, the U.S. government acquiesced to accounting rules adopted by the financial industry that allowed banks and other corporations to take money-losing assets off their balance sheets in order to hide them from investors and the public. None of these milestones on the road to economic ruin were kept secret, says Rosenfield. The dangers posed by unregulated, greed-driven financial speculation were readily apparent to any astute observer of the financial system but few of those entrusted with the responsibility to police the marketplace were willing to do so and those officials in government who dared to propose stronger protections for investors and consumers consistently met with hostility and defeat. The power of the Money Industry overcame all opposition, on a bipartisan basis. Derivatives were their Weapons of Mass Destruction As Franklin Roosevelt observed seventy years ago, "our enemies of today are the forces of privilege and greed within our own borders" and today, says Rosenfield, their weapons of mass destruction were derivatives: pieces of paper that were backed by other pieces of paper that were backed by packages of mortgages, student loans and credit card debt, the complexity and value of which only a few understood. In fact, says Rosenfield: "America's economic system is where it is today because gambling became the financial sector's principal preoccupation. The pile of chips grew so big that the Money Industry displaced real businesses that provided real goods, services and jobs." The Purchase of America was a LBO Rosenfield believes that the American consumers are not to blame for this debacle nor those who used credit in an attempt to have a decent quality of life, nor those who agreed to accept the amazing terms for mortgages and finding out later that they had been misled and could not afford the loan at the real interest rate buried in the fine print. Instead of assuming any responsibility for living beyond their means Rosenfield believes Americans are only to blame for "allowing Wall Street to do what it calls a leveraged buy out of our political system by spending a relatively small amount of capital in the Capitol in order to seize control of our economy". The Privileges of the Financial Oligarchy are Being Preserved Rosenfield contends that the moment the Money Industry realized that the casino had closed, it turned - as it always does - to Washington, this time for the mother of all favors: a $700 billion bailout which was quickly extended to include a feast of discount loans, loan guarantees and other taxpayer subsidies to the tune of at least $8 trillion so far. Then, panicked by Wall Street's threat to pull the plug on credit, Congress rebuffed efforts to include safeguards on how taxpayer money would be spent and accounted for. Rosenfield is of the opinion that the bankers used the bailout monies to pay bonuses, to buy back their own bank stock, or to build their empires by purchasing other banks with very little of the money being used for the purpose it was ostensibly given: to make loans. He is absolutely convinced that Washington's latest giveaway - the Greatest Wall Street Giveaway of all time as he calls it - has not fixed the economy but that, at this very moment of national threat, the banks, hedge funds and other parasite firms that crippled our economy are pouring money into Washington to preserve their privileges at the expense of the rest of us. Washington Was Paid Off That's why, according to Rosenfield, you won't hear anyone in the Washington establishment suggest that Americans be given a seat on the Board of Directors of every company that receives bailout money or that credit default swaps and other derivatives should be prohibited, or limited just like slot machines, roulette wheels and other forms of gambling. In most of the United States, he says, you can go to jail for stealing a loaf of bread but if you have paid off Washington, you can steal the life-savings, livelihoods, homes and dreams of an entire nation, and you will be allowed to live in the fancy homes you own, drive multiple cars, throw multi-million dollar birthday parties, etc. and virtually get away with it. Sure, he points out, you might not be able to get your bonus this year or, worst come to worst, if you are one of the very unlucky few unable to take advantage of the loopholes in the plan announced by the Treasury Secretary Geithner, you may end up having to live off your past riches because you can only earn a measly $500,000. The Money Industry Remains in Charge Rosenfield believes that since President Obama's key appointments to the Treasury, the SEC and other agencies, like their predecessors, are veterans of the Money Industry that the Money Industry remains in charge of the federal agencies and keeps our elected officials in its deep pockets and, as such, nothing will change and that: ..."if America is to recover from this economic debacle that we find ourselves in, its people must return to the principles that made it great - hard work, creativity, and innovation - and both government and business must serve that end. Washington must serve America, not Wall Street. Things will not change so long as Americans acquiesce to business as usual in Washington. It's time for Americans to make their voices heard." The report concludes that Wall Street is presently humbled, but not prostrate. Despite siphoning trillions of dollars from the public purse, Wall Street executives continue to warn about the perils of restricting "financial innovation" even though it was these very innovations that led to the crisis in the first place and they are scheming to use the coming Congressional focus on financial regulation to centralize authority with industry- friendly agencies. "If we are to see the meaningful regulation we need, Congress must adopt the view that Wall Street has no legitimate seat at the table. With Wall Street having destroyed the system that enriched its high flyers, and plunged the global economy into deep recession, it's time for Congress to tell Wall Street that its political investments have also gone bad. This time, legislating must be to control Wall Street, not further Wall Street's control." God Bless America My recent "America's Financial Oligarchy is Still in Control" article concluded that the country is in financial crisis and instead of the financial oligarchy being broken up to permit essential reform they are continuing to use their influence to prevent precisely the sorts of reforms that are needed immediately to pull the economy out of its nosedive. Moreover, our legislators seem unwilling to act against these powerful financiers opting instead to succumb to their power and influence and continue to give them what they deem to be in their best interest instead of that of the taxpayers'. Rosenfield goes one step further in claiming that the Money Industry has, in fact, bought control of the American political system and, in the process, betrayed America's trust in them. They are still in control and there is no end in sight. Indeed, the long-term consequences for America are so dire I think it is incumbent upon us to evoke the words of the anthem "God Bless America" with its stirring words "stand beside her and guide her." I think you would agree, regardless of party affiliation or leanings, that America needs all the help it can get! How Best to Invest My letter to friends in June 2004, which was eventually posted on the internet in January 2006 as "Our Worst Nightmare: The Puncture of the Current U.S. Housing Bubble", concluded by asking the rhetorical question "So where should we be investing our money?" and I replied by saying "Certainly not in real estate. Definitely not in bonds. Absolutely not in the general stock market. What's left! Well, there is cash (at least you won't lose your shirt) and gold bullion ... and, by extension, large cap gold mining company stock and their warrants." Not much has changed since then. I rest my case. Lorimer Wilson His articles cover investing in times of crisis, commodities, market timing and other investment philosophies. He is a Contributing Editor to www.preciousmetalswarrants.com and can be contacted at: lorimer.wilson@live.com |

Robert Weissman & James Donahue - Sold Out: How Wall Street and Washington Betrayed America

Publish at Scribd or explore others: Books Non-fiction wall America

Global Financial Meltdown: Forces beyond our control? Or the biggest Sting ever? - by Dave Patterson

Fri, 05/01/2009 - 11:34 — McJGlobal Financial Meltdown: Forces beyond our control? Or the biggest Sting ever?

by Dave Patterson

March 2009

http://www.rudemacedon.ca/greatest-sting-ever.html

To listen to the news these days, with its endless stories of yet more tragedies amongst 'we the people', you would think it was all just some inevitable unfolding of history, some kind of natural disaster that happens every now and then that we can do nothing about, but just have to grit our teeth and get through it, like the big ice storm a few years ago, or the recent tsunami that took so many lives around the coastal areas of the Indian Ocean, or the hurricanes that regularly strike around the Gulf of Mexico, and etc. Every day we hear on the news more stories of the latest victims, and how our noble governments are trying their very best to steer our ships of state through these troubled waters.

Like so much of what we hear on the news, this is all one step short of what is really going on in our lives, in the world around us. The stories of human tragedies amongst we the little people are true enough - but what they are lying about is the 'natural disaster' aspect of it all. These tragedies we read of, the job losses, the loss of huge amounts of money and property by 'average' citizens, need not have happened at all. What we are really seeing is the biggest sting ever perpetrated in history, conducted by the elite who control our society, using the vehicles of the banks and governments and media they control to feed us all the basic sting story of unforeseen, unforeseeable, unprecedented natural disaster, whilst behind the scenes and even brazenly in the open in front of our mesmerized eyes transferring vast amounts of the wealth produced by the working people of the world into their own private coffers in the name of dealing with this 'disaster', and using the fear and uncertainty to impose debts that our children and their children will be paying off, to these same scamsters, for decades to come.

As with any sting, there are many marks and few scamsters, and we could stop them if we just stood up together and said we are not going to allow this theft. We are going to take the lot of you, put you on public trial for vast fraud, take our money and countries back, and send you all to jail for the rest of your lives.

We could. The question is, will we? If most of us continue to sit in front of the televisions and believe the sting 'terrible tragedy nobody could have seen it coming!!' stories they feed us every day, it is unlikely that any uprising will occur - what can you do about a 'natural unpreventable disaster' except do your share, shoulder to shoulder, to stand strongly against the forces of nature, and rebuild our society together? But if you turn off the television, and turn on your brain, and realise what a huge scam this whole thing really is, and the brazen theft of not only your money but the money of your children and grandchildren who will be paying these fraudulent debts for generations - then maybe you will find the strength and wisdom to do what is really necessary - stand up and say No More!!! - take control of your democracy, take back your money from those who are stealing it in front of your very faces, and send all of them to jail for the rest of their lives.

Manic Depressive People Can Be Helped - So Can Manic Depressive Economies

Our 'modern' economy has all the symptoms of someone with manic-depressive disorder, bouncing between periods of great exuberance followed by periods of depression. This is somewhat misleadingly referred to by our 'experts' (economists, financial leaders, business commentators, etc) who influence the policies under which our economy operates as the 'boom-bust business cycle', as if they are, with their great learning, pontificating some great Law of Nature that cannot be changed or challenged but only dealt with as best we all can when the regular cyclical disasters such as we are facing today fall upon us. But these modern priests of the god mammon speak falsely, whether from ignorance or perfidy, and such disasters need not occur at all. Think of automobiles - we could remove all road rules and policemen, and call the resulting carnage a 'law of nature' as people do what comes naturally - or we can choose to say that letting people do as they wish on our highways does not qualify as an immutable law of nature, and this carnage is not acceptable in a civilized society looking out for all of its citizens rather than letting the few crazies behave as they wish, and can be minimized, and do so.

And we could do the same with things economic, if we wanted to. We could choose sanity over insanity, a stable economy over a roller coaster casino economy that is great fun and very profitable for the few and highly precarious and periodically disastrous for the many, if 'we' (as in 'We the People') understood what was happening with our economy, and the choices available as to whether we allow this manic-depressive 'business' cycle to be the norm, or whether we choose to run our economy in a more stable way, to legislate the psychotic drivers who make life precarious for everyone off of our national financial highway. It is simply a matter of political will - however, unfortunately for most of us, currently the decisions that determine what happens in 'our' economy - the actual manifestations of 'political will' - are in the hands of a select group of people who prefer this manic-depressive cycle and thus ensure that our financial system and laws enable this 'business cycle' rather than control it, as they make a lot of money from it in either stage. Also, collectively, of course, the same people, as the ones with the money, pretty much manage the overall direction of our market-oriented 'everything for sale to the highest bidder, including politicians' society, with 'we the people', with far too little money to be purchasing the services of these highest of the high rollers, reduced to 'choosing' between Banker Bob and Lawyer Lois every few years then sitting back in front of our televisions to see what they are doing, with no real power to influence anything between 'elections'. The same people, via the same purchasing power, also control the media, and thus ensure we don't get any real information about what is going on with either the financial policies or the enabling political decisions, or other options that might jeopardize their power. With considerable success, it must be said, as few of 'we the people' seem to have any real idea of what is happening with our economy, or that we could do something about these destructive cycles, and don't take to the streets in protest at the great theft of our wealth engineered by the current policies, which are very much policies of choice rather than necessity, choices which are very good for the few, and very bad for the many.

But if you would like to see your society on a somewhat more even keel financially than this boom-bust-bubble roller coaster thing they pretend is some kind of law-of-nature 'business cycle', read on. If the sight of pension funds vanishing in the market maelstrom troubles you, or the hundreds of thousands of job losses we are seeing as the economy contracts, or the thought of the government going even deeper into debt, for which your children will surely be paying for decades to come if the status quo is not challenged, or you think there should be a better way to organise things than watching the price of oil and housing and the stock market and even your currency bouncing around like ping pong balls as the global speculators play unhindered in our societies, read on. There are indeed other ways to run our economy, other much more stable ways, than having Mad Uncle Milton, and Steve and Mark and Jim and the others in their gang, at the wheel.

If you want it, you can have it. But you'll have to demand it and then take it, for it is certain that the captains of the good ship Midas the Golden Goose surely won't surrender their positions without a serious struggle.

As Henry said, look for the root ...

The first part of the struggle of We the People to gain control of our economy and lives comes with knowledge, knowledge of the way things work that the current economic overlords, and their enabling managers, have but we do not. Understanding the source of any problem is fundamental to fixing it. Bowing to the god Mammon and believing without question the pronouncements of its high priests is the path to continuing slavery - understanding their lies is the path to freedom. And the source of every major economic problem we face today (and have for the last couple of hundred years) is that most of our money - the money that is the lifeblood of a modern economy, that controls everything we do - is controlled and created as debt by commercial banks, with (currently) no realistic, government-controlled limits imposed on the amount created, and upon which they demand interest every year.1

Don't race on, this is not some esoteric factoid of theoretical interest only to egghead economists or quantum physicists, it is the single most important fact of all, the fact that, if understood, can open the door that will show the way to a new and sane economic regime for all of us, a fact that explains every problem we face today, and if you want to be part of the solution rather than just another of the millions of victims, you have to understand this fact, and what it means.

Let's then repeat it once again - 'our' government does not provide our money supply, nor even control how much is created. And all major problems we face in the world today arise from this single, simple fact.2

This is it, one simple fact, but a fact known by very few people which is the key to everything: commercial banks create virtually all of our 'money', out of thin air, as loans, simply by punching numbers into a computer.

The ramifications of this one simple fact are huge. So huge that the current world economic meltdown is a direct result of this simple fact. Every bubble that has burst over the last few decades, with huge loss of money, is the result of this one simple fact. The Canadian national debt, that has been used as the excuse for so many cutbacks to Canadian social programs, the lack of money that has led to crumbling infrastructure, the huge increases in post-secondary education expenses, the long waiting lines at hospitals, the declining savings and increased debt faced by all Canadians, all of these and every other economic problem we face, are due to this one simple fact - commercial banks create virtually all of the Canadian money supply as debt.

And this is a matter of policy which can be changed at will, not some kind of 'law of nature' that we can do nothing about.

A couple of related facts to help put this in perspective:

There is about $50 billion of 'real' Canadian money, bank notes and coins, in circulation, the money you are most familiar with, that you take from your pocket or wallet when you need to pay for your hamburger or some groceries or gas or movie tickets or rides at the fair or any of the millions of little transactions that occur every day in Canada between consumers and small businesses. But this is only the smallest amount of all the 'money' we use - there is also at least $3 Trillion of Canadian debt outstanding, business, consumer and government. Although the myth they want you to believe is that 'loans' are simply bank deposit money that banks lend out, you can see that it would be more than a bit difficult to arrange $3 Trillion in loans from $50 billion in deposits of this 'real money' by simply loaning out 'your' deposits that you or other depositors are not currently using - and even more so when you figure that most of that $50 Billion is not deposited in banks anyway, but circulating in the pockets of every Canadian citizen and business to conduct normal daily cash transactions, as well as good chunks of it floating around most countries in the world in money changers' shops etc. It is this $3 trillion in debt that comprises the great bulk of the Canadian money supply, that is shuffling around electronically between the millions of personal and business bank accounts every day, that I am talking about when I say commercial banks create almost all of our money supply, and that lies at the root of our current meltdown and other financial problems.3

It may not be immediately clear why this is such a problem. But think of it, just imagine this process and let it become clear in your head, for this is the first and major thing we need to understand and change if we want to establish a stable economy. Essentially, to create 98% of the nation's circulating electronic money supply, all that money changing hands every day via credit and debit cards and cheques, banks make loans to businesses, consumers or governments, creating that loaned money out of thin air. And then, when the loan is paid back, the money is 'uncreated' - and then they make other loans, which keep money available and circulating in the country, an endless, ongoing creation-uncreation process, like the ocean tides going in and out - with an equally never-ending demand for interest on the continually extinguished and re-birthed debt-money supply. And so the great bulk of the nation's money supply is this vast collection of loans, endlessly coming into existence for a short period of time, upon which interest must be paid of course, and then vanishing after doing their job of transferring that interest charge from a producing member of society to the businesses which control this money-creation machine, essentially imaginary money that people shuffle around between credit accounts, with every transaction thus undertaken additionally being skimmed a service charge, as every credit-dollar that is created is assessed interest, on and on and on and on, world without end. This is truly the golden goose laying an endless supply of golden eggs for those who control it, or the Midas touch for those who control this great power, as everything they touch turns to gold for them.

Well, respond those who still do not see the great problems with this, of course we need money to do the things we do in modern societies, buying things, getting paid for our work, etc, and it has to come from somewhere, so why is it so bad to have it coming from banks, which would seem to be a logical enough choice, considering they are in the 'money' business? And they seem to have been doing a pretty good job over the years, considering the prosperity of Canada, and other western countries ....

Actually, aside from the rather obvious evidence of the current world economic meltdown that something is seriously wrong with the system and maybe they haven't been doing such a good job at all (at least for those millions of people currently facing financial loss or ruin), this form of supplying our money is, very, very, very bad - so bad that the current financial meltdown, as I noted earlier, was a built-in, completely inevitable result. Kind of like playing tag on a small raft in the middle of the ocean - lots of laughs and thrills for awhile, but sooner or later it's going over. And then the laughs stop.

Let's look at this situation from a perspective you don't read in the mainstream Canadian media - media controlled, again of course, by the same people who control the banks, and are thus inclined to offer a certain perspective which is favorable to them, and disinclined to point out some things that might cast a somewhat more unfavorable light on their activities, even in this vast global meltdown we are currently experiencing, when casting a light on some truthful things might see a lot of people being charged with some very serious crimes rather than negotiating how big a bailout they are going to get.

There are three major, interrelated reasons why letting commercial banks create virtually all of our money is so very bad (well, bad for 'we the people', obviously a pretty good game for the banks and their owners and 'investors' and paid flunkies who support them in government and media - but are we running our economy for the well being of the small number of banks and their owner-investors and hangers-on, or the mass of people in our society as a whole? Again, this is not a trivial question - if you take a careful look around the last 30 years or so, with some thoughts gleaned from sources other than your mainstream Canadian media, the answer may not be the one you think obvious ...).

First - the interest: Interest may be a somewhat unpleasant but not unreasonable fact of life in some settings, for instance when a private citizen borrows already existing money from someone, as there is the idea of 'loss of use', or 'rental fee', that the lender is giving up something they could use productively to the extent the borrowed money diminishes the assets available to the lender, or even from a bank which pays interest on ('real' money) deposits and thus charges interest on loans, with its profit the difference. But it is very much another story when 'interest' is levied on the nation's entire money supply that we require to do the millions of daily transactions that are done in a modern country each day, and most especially when such 'interest' does not in any way compensate for any 'loss of use' suffered by the lender, since in the case of the bulk of the nation's money supply provided by the banks, they simply create it out of thin air by punching those numbers into their bank computers, making the 'interest' a 100% windfall payment to those commercial interests allowed to do the creating - and you can see that even in Canada, this is a pretty serious windfall, when the amount of such 'created from thin air' money is at least $3 trillion per year (this principle is somewhat muddied by the fact that loans get used to buy things, and the person receiving such money usually then deposits that money in a different bank, which gives that deposit account the superficial appearance of 'real' money, but the essential arguments I make here about the problems with allowing the nation's money supply to be loaned into existence are not diminished by this thaumaturgy). And remember also this is not even one-time interest in the great majority of cases, but year after year after year interest, compounding and compounding and compounding interest, on money created out of thin air. One might make an argument for the banks assessing a service charge of some sort on this created money, if we as a nation decided to allow our money to be supplied this way, but that is very much not what they do, and part of a different discussion.

It is kind of shocking when you think of this - our nation's money supply is basically imaginary. The banks create into existence through loans the electronic money that comprises the great bulk of our national 'money' supply, but that 'money' is not real, but exists only in your bank account, and the bank accounts of millions of other people and businesses, and is transferred between your bank account and others during the life of the loans that brought the imaginary money into existence. And the dangerous part is, the part that leads very inevitably to the kind of economical meltdown you see in the world today, is that with this system of money creation, you and all of us pay interest on those loans every year they are outstanding, which means we are paying interest on our very money supply, the lifeblood of our economy and modern lives, endlessly. Endlessly. Endlessly.

So that is where 98%+ of your Canadian money supply comes from - banks punching numbers into computers and creating money-as-debt, upon which they then charge interest, month after month, year after year - money created for your new car, or a young couple's new house, or for wealthy speculators to go gambling on the stock market or in the foreign currency market, or for the Canadian government to go further into debt, all created by commercial banks looking to make a profit for their investors. And as we all well know, a very good profit they make indeed, from all that interest and service charges.

And although the people who want you to not think about this very much at all refer to this 'interest' as simply a 'business expense', as inevitable and natural and generally harmless as the night following the day, this is very much understating the actual seriousness of what is going on right under our very noses, day after day, month after month, year after year, decade after decade, as we pay interest on our very money supply, on the lifeblood of the nation, and pay and pay and pay and pay.

And although the windfall profits accruing to the commercial banks and their investors - windfall profits on at least $3 Trillion of created money each year in Canada alone - are certainly by themselves a good enough reason to examine this situation somewhat more closely than we ever have, there are much deeper and far more serious ramifications than the simple 'windfall' profits these commercial banks amass for the privileged few who are blessed with this great 'business' of creating and managing the nation's money supply.

Turn of the Screw the First: Systemic interest >> Systemic inflation: When you pay interest on virtually your entire money supply, you have built-in, systemic inflation - how can you not? Those who pretend to be the guardians of our economy, and teach us about it, and comment on it, point to oil shocks and workers demanding wage increases and house prices or food prices rising or similar things, and try to get you to believe that such things are the cause( of inflation, insofar as it can be explained at all and is not just some kind of natural disaster like a hurricane or ice storm that we can't really foresee or do much about except deal with after it strikes. However, although such things may be contributory, any of them taken alone are transient and not enough to cause ongoing national inflation, year after year, and they are also to a substantial extent responses to inflation rather than causes, and thus the argument is essentially tautological. But what is factual and straightforward and obvious to those who are able to think beyond the dogma fed to everyone by the economists and bankers et al is that when you have to pay interest on essentially your entire money supply each year, which is a big money supply and thus requires a lot of interest, year in and year out, in a system which is centered around businesses which must turn a profit each year or go broke, then as businesses try to keep up with the simple built-in cost of using the money they rely on to conduct their business dealings each year by raising prices rather than watching profits drop every year by the amount of interest the country pays on its money supply, inflation is built in and systemic.

of inflation, insofar as it can be explained at all and is not just some kind of natural disaster like a hurricane or ice storm that we can't really foresee or do much about except deal with after it strikes. However, although such things may be contributory, any of them taken alone are transient and not enough to cause ongoing national inflation, year after year, and they are also to a substantial extent responses to inflation rather than causes, and thus the argument is essentially tautological. But what is factual and straightforward and obvious to those who are able to think beyond the dogma fed to everyone by the economists and bankers et al is that when you have to pay interest on essentially your entire money supply each year, which is a big money supply and thus requires a lot of interest, year in and year out, in a system which is centered around businesses which must turn a profit each year or go broke, then as businesses try to keep up with the simple built-in cost of using the money they rely on to conduct their business dealings each year by raising prices rather than watching profits drop every year by the amount of interest the country pays on its money supply, inflation is built in and systemic.

And inflation, of course, impacts different sectors differently, but the impact is always heavier the further away from power you are, the lower in the social hierarchy - that is, the people at the mid and bottom levels of society are impacted the heaviest, as everything they use money for costs more, and more, and more year after year after year - but their incomes, whether government social support, or minimum/low wage jobs, or even unionized or non-unionized middle-class jobs (that is to say, the 85% or so of people who rely on 'jobs' for their income), never keep up. Professionals and top-level managers (and the politicians of course who are central in selling and maintaining this whole scam so are well looked after) always look after their incomes, and businesses raise prices as they wish - but the income of workers does not go up as *you* wish, and it takes much fighting to get raises that offset inflation even partially. Thus the reality everyone is aware of, for any middle/lower-class working family - whereas 30-40-50 years ago one person with a half-decent job could easily support a middle-class lifestyle and family, buy a house, save for retirement, put the kids through university, etc - in the last years of the 20th century and the opening decade of the 21st century, it takes two working adults to do these things for most families, and even with two people working most families are still falling further and further behind, as savings are far below what they were ~40 years ago (as a percent of income etc), and debt much higher. And this increasing pressure, this diminishment of security and savings and increasing debt, is all the inevitable result of the systemic inflation that results when we allow banks to create virtually all of our money supply, and charge interest on it, and there is no other place to get that interest year after year after year than through the inflationary process of creating more new money to cover the old debt, and that inflation eats into everyone's income as most of us cannot self-adjust our incomes to keep up.

(note - there are a number of references to '30-40 years ago' in the essay - this is because this is when the current economic crisis was birthed. After the great crash of 29, which was caused by exactly the same thing as the current meltdown/crisis (unregulated banks creating vastly more money than could be justified by the actual goods and services available in the real economy), governments throughout the western world, facing some very large numbers of very angry people looking for explanations and reassurances that such a disaster would happen no more, that their children would not suffer such a calamity, put in place various measures to control the banks and their money-creation power, to prevent another such meltdown. By the 1970s, however, with the prosperity enabled at least partly through such controls, the children now of the children of those days had forgotten about these controls altogether and what they had been established for, not without, of course, some considerable assistance from the corporations and banks, who were lobbying strongly and largely behind the scenes to have these controls removed, and in due time with little fuss they were. And the result was as inevitable as night following the day, or blindfolding your kid and putting him on his new bicycle and sending him out for a ride on the street. It is also relevant to consider another important contributory fact, that prior to the 70s, the western world was much more a 'cash-based' society - it is only in the years since then, through various technological advances, that the use of various forms of electronically-transferred 'credit' has rather quickly become so dominant in our daily activities, and the use of such credit as a money supply has become ever easier for commercial banks to create with little or no real oversight, and these things have never been properly understood or dealt with by our democratic governments - but the opportunities inherent therein for those controlling the electronic money have, of course, been much more quickly understood by the banks and the bank investors and their clever lawyers and economists, always alert to new ways to leverage their unique position of trust and power for profit, who have been, obviously, ready to take advantage of these new forms of electronic money and credit, and the lack of understanding of the average person, to the max.))