April 2009

Who is behind Moldova's Twitter Revolution? - by José Miguel Alonso Trabanco

Thu, 04/30/2009 - 17:47 — McJWho is behind Moldova's Twitter Revolution?

by José Miguel Alonso Trabanco

Global Research, April 11, 2009

http://www.globalresearch.ca/index.php?context=va&aid=13147

"A lot of what we [National Endowment for Democracy] do today was done covertly 25 years ago by the CIA." -Allen Weinstein

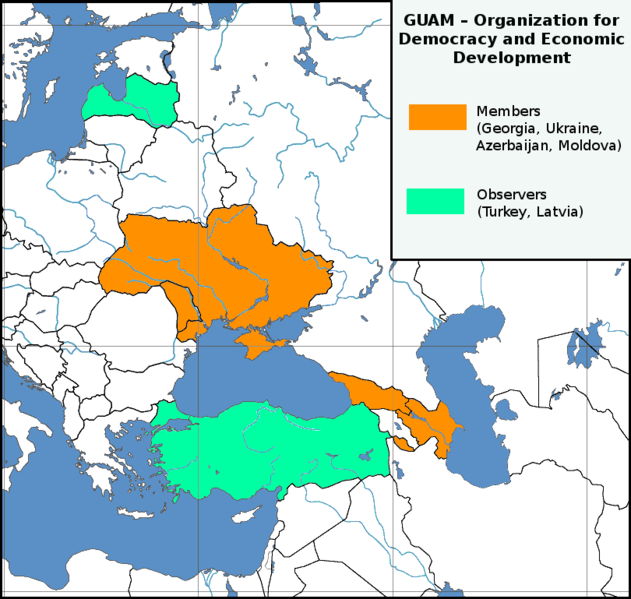

It seems that those who anticipated the end of color revolutions have been proven wrong. So far, color revolutions have succeeded in Serbia, Georgia, Ukraine and Kyrgyzstan. On the other hand, they have failed in Belarus, Uzbekistan and Myanmar. Their common denominator is a wave of protests and sometimes riots whose purpose is to overthrow a local government, often held during electoral times or shortly afterwards. It has not gone unnoticed that the so called color revolutions have been backed (and engineered?) by enthusiastic western supporters including NGO's, diplomats, businessmen, governmental institutions and heads of state. In those countries where such political mobilizations have prevailed, pro-Western leaders have been enthroned as a result thereof. If one pays close attention to a map, it is impossible not to wonder if it is simply a coincidence that color revolutions have erupted in countries close to Russian and Chinese borders. It has to be pointed out that no color revolution has ever occurred in any country whose government is staunchly pro-Western.

Today, it is indeed quite likely that events taking place in Moldova are none other than the evident signs of the latest color revolution. Only a few days ago, elections were held there and the official announcement of preliminary results of the electoral process showed that the Party of Communists of the Republic of Moldova (affiliated to the Party of the European Left) had received nearly 50% of the votes. The Organization for Security and Co-operation in Europe (OSCE) certified that Moldovan parliamentary elections were free and fair. Nevertheless, protests attended by tens of thousands started shortly afterwards. However, these demonstrations can hardly be described as peaceful since media reports confirm that organized violence has targeted government facilities, including the parliament building as well as a presidential office. The script bears some similarities with Ukraine's Orange Revolution, which started with large protests demanding new elections once opposition politicians were discontent with electoral results.

It is telling that protestors have been photographed waving the flags of both Romania and the European Union. They have also requested the ouster of Moldova's current government, denouncing it as a "totalitarian regime" and demanded parliamentary elections to be re-scheduled. So far, Moldovan law enforcement has been overwhelmed and is unable to control these riots even though it has resorted to tear gas and water cannons. Moldovan senior government officials have stated that they regard these episodes of civil unrest as unlawful and that they will act accordingly. Furthermore, the Romanian ambassador in Moldova has been declared persona non grata and visa requirements for Romanian nationals have been established. Also, pro-Moldovan protesters rallies have taken place in many cities throughout Romania. Although no color has been chosen to name this color revolution, these events have already been termed as the Twitter Revolution because on-site reports indicate that protest organizers have made extensive use of social-networking tools in order to fuel discontent.

To determine whether or not any event is geopolitically significant, the timing is an element which always needs to be taken into account. The post Soviet space is one of the most active arenas of great power strategic competition and there are some meaningful recent precedents such as:

· The fact that Ukraine and Georgia have not been accepted as NATO members in spite of intense diplomatic pressure by prominent NATO members.

· Unlike other post Soviet states, Moldova's government had declared that Chişinău would remain neutral and that it would thus refuse to side with great powers, which more or less resembles the position taken by fellow former Soviet Republic Turkmenistan whose foreign policy must meet criteria of strict neutrality.

· The Russo-Georgian war in which Moscow inflicted a military defeat on strongly pro-Western Georgia.

· The announcement by the Kyrgyz government that the Manas air base will be closed.

· The European Union launched its Eastern Partnership project, designed by Poland and Sweden to reach out to Ukraine, Belarus, Azerbaijan, Georgia, Moldova and Armenia. This was seen in Moscow as an attempt to co-opt these countries and marginalize them away from Russian influence.

· Ukraine's decision to hold anticipated elections. It might be added that pro-Western Viktor Yuschchenko's candidacy does not look particularly promising.

The above demonstrates that the geopolitical rivalry between Russia and NATO has been intensifying. In fact, Russian senior politicians are already claiming that civil unrest in Moldova is been orchestrated by western intelligence survives. They have also emphasized that the ultimate goal is to accomplish regime change in Chişinău so NATO member Romania can swallow Moldova. It is no secret that hardline nationalists in Bucharest would like to achieve Anschluss with Moldova. Yet Western governments have refrained from voicing a strong support for the anti-government crowd in Moldova. However, it is necessary to explore what Western interests could consist of in this tiny post Soviet republic.

Why Moldova?

Moldova was one of the poorest and less developed republics of the Soviet Union, as well as the most densely populated. It is a landlocked country contiguous to Romania and Ukraine. Soviet planners had decided that Moldova would specialize in food production. Nevertheless, Moldova was not entirely homogeneous. The country's industrial infrastructure was built in Transnistria, a region mostly populated by people of Slavic ethnicity (i.e. Russians and Ukrainians). This region was responsible for a large of percentage of Moldova's GDP (40%) and it also contributed with almost the entire power generation of the Moldovan SSR. Toward the end of the Cold War, Romanian dictator Nicolae Ceauşescu had stated that the Kremlin had annexed Bessarabia (aka Moldova), which implied that he considered it as a part of Romania.

The disintegration of the Soviet Union changed little. The overall Moldovan economy is not specially outstanding since it exports wine, fruits and other beverages and food products. Moldova is a net importer of coal, oil and gas since if has no natural deposits of any of these resources. According to the CIA World Factbook, Moldova ranks 138th in a list of countries arranged by GDP.

Transnistria declared its independence from Moldova following the Soviet collapse because it was fearful of an increasingly nationalistic Moldova and the reemergence of pro-Romanian sentiment. This triggered a war between Chişinău and Transnistrian separatists. Russian forces were then deployed in order to end hostilities. The conflict has been frozen ever since. Nevertheless, the presence of Russian military personnel (which numbers nearly 3000) has allowed Transnistria to keep its de facto independence from Molvoda even though it still formally belongs to the latter. Indeed, Transnistria has its own authorities, military, law enforcement, currency, public services, flag, national anthem, constitution and coat of arms. Nearly half of Transnistrian exports are shipped to Russia.

Russia has supported Transnistria because it is inhabited by a considerable proportion of ethnic Russians loyal to Moscow; this must not be born in mind because people is Russia's scarcest resource. Furthermore, Transnistria is located in the easternmost region on Moldova and, more importantly, it borders Ukraine. Last but not least, Transnistria's small economy is based on heavy industry, textile production and power generation, which represents an additional atractive. As a result of Russian involvement, Chişinău has been careful not to be antagonistic toward Moscow.

Moldova's current president, Vladimir Voronin (the name can be misleading but he is, in fact, an ethnic Romanian), was elected in 2001 as the candidate of the Party of Communists of the Republic of Moldova. Regardless of his party's name, his administration can be described a pragmatic; for instance, he decided to continue privatization plans first put forward by his predecessor. Back in 2002, he angered nationalists by designating the Russian language as a second official language. Nevertheless, it would be a mistake to brand him as pro-Russian because his foreign policy has been seeking to balance Russian and Western interests without having to take sides. For example, his administration has expressed a desire to establish closer ties with the EU (which even runs a permanent mission in Chişinău) and cooperation with NATO and Russia, excluding membership in the Atlantic alliance or in the Russian-led CSTO. Furthermore, Voronin's government has stressed Moldova's need to preserve its independece instead of being absorbed by Romania. In short, he is neither pro-Russian (like Alexander Lukashenko) nor pro-Western (like Mikheil Saakashvili). Rather, his political position is closer to those of Ukraine's Kuchma, Georgia's Shevardnadze or even Turkmenistan's Niyazov and Berdymukhamedov.

Nonetheless, it is not far-fetched to assume that NATO in general and the US in particular are interested in regime change in Moldova. The main goal would be to overthrow the current Moldovan government and have it replaced by rulers more antagonistic toward Moscow. If such attempt succeeds, a new government in Moldova could be harangued into expelling Russian troops from Transnistria in an effort to rollback Russian military presence away from Eastern Europe, an effort meant to diminish Russian influence in the post Soviet space and to undermine Russia's prestige there and elsewhere. Moreover, it could be a Western reminder to Moscow that the slightest Russian distraction will be taken advantage of by NATO. A hypothetical pro-Western Moldova could even be later incorporated into NATO member Romania, moving the alliance borders eastward bypassing ordinary acceptance protocols for new members.

It remains to be seen if the Kremlin was caught by surprise and it is unclear how it will ultimately react to an eventual regime change in Chişinău, particularly if any new government attempts to take over Transnistria by force, much like Georgia did last year concerning South Ossetia. What is clear, however, is that Moscow does not want to be trapped into a conflict which could drain financial, military, diplomatic and political resources. Yet, Russian decision makers do not like what they are witnessing in Moldova; it is a script that had seen at play before. Therefore, it is reasonable to assert that Russia will resort to its intelligence assets it operates overseas in order to counter anti-Russian moves in Moldova before any deployment of troops is seriously considered. It is still too early to accurately foresee what defining developments will take place in Moldova and how they will unfold. If the current Moldovan government survives, the Twitter Revolution there could backfire. If that is indeed the case, Moldova's rulers could end up openly embracing Moscow as a result of real or alleged Western covert support for anti-government forces.

Russian accusations regarding the involvement of Western intelligence agencies has not been proved because all clandestine operations operate on the principle of plausible denial. Nonetheless, there are circumstantial facts which seem to demonstrate foreign intervention. For instance, some Western semi official institutions and NGO's openly acknowledged their activities in Moldova. For example:

· The USAID website concerning the agency's activities in Moldova mentions that some of them include "Moldova Citizen Participation Program", "Strengthening Democratic Political Activism in Moldova" and "Internet Access and Training Program". The latter is noteworthy because online social networks have been employed in order to increase anti-government activism. USAID's website specifies that "[its program] provides local communities with free access to the internet and to extensive training in all aspects of information technology". It goes on to explain that "Target groups include local government officials, journalists, students, local NGO representatives, professors and healthcare providers..."

Those examples are particularly revealing if one takes into consideration that those organizations were prominent participants in previous color revolutions. That is, both the players and the Modus Operandi remains largely unchanged. A notorious protagonist and organizer of the Twitter Revolution is journalist Natalia Morar who used to work as press secretary for "The Other Russia", a strange coalition of anti-Putin political groups which encompasses hardline nationalists, communists and pro-Western activists.

In short, bearing in mind all of the above, it looks like a new episode of geopolitical confrontation between Russia and the West is unfolding in Moldova. This battle is not over yet and whatever its outcome turns out to be, its strategic implications will be deep because they will send strong shockwaves throughout Eastern Europe and the post Soviet space. The stakes are certainly being raised in this new round of the Great Game. A few years ago, notorious neocon pundit Charles Krauthammer observed that "This [Ukraine's Orange Revolution] is about Russia first, democracy second". The same phrase applies to Moldova's Twitter Revolution.

José Miguel Alonso Trabanco is an independent writer based in Mexico specialising in geopoltical and military affairs. He has a degree in International Relations from the Monterrey Institute of Technology and Higher Studies, Mexico City. His focus is on contemporary and historic geopolitics, the world's balance of power, the international system's architecture and the emergence of new powers.

José Miguel Alonso Trabanco is a frequent contributor to Global Research. Global Research Articles by José Miguel Alonso Trabanco.

Swine Flu Alert by Dr. Mercola

Wed, 04/29/2009 - 14:36 — adminCopied from http://articles.mercola.com/sites/articles/archive/2009/04/29/Swine-Flu....

Critical Alert: The Swine Flu Pandemic – Fact or Fiction?

By Dr. Mercola

American health officials declared a public health emergency as cases of swine flu were confirmed in the U.S. Health officials across the world fear this could be the leading edge of a global pandemic emerging from Mexico, where seven people are confirmed dead as a result of the new virus.

On Monday April 27th, the World Health Organization (WHO) raised its pandemic alert level to four on its six-level threat scale,1 which means they've determined that the virus is capable of human-to-human transmission. The initial outbreaks across North America reveal an infection already traveling at higher velocity than did the last official pandemic strain, the 1968 Hong Kong flu.

swine fluThe number of fatalities, and suspected and confirmed cases across the world change depending on the source, so your best bet -- if you want the latest numbers -- is to use Google Maps' Swine Flu Tracker.

Several nations have imposed travel bans, or made plans to quarantine air travelers2 that present symptoms of the swine flu, such as:

* Fever of more than 100

* Coughing

* Runny nose and/or sore throat

* Joint aches

* Severe headache

* Vomiting and/or diarrhea

* Lethargy

* Lack of appetite

Top global flu experts are trying to predict how dangerous the new swine flu strain will be, as it became clear that they had little information about Mexico's outbreak. It is as yet unclear how many cases occurred in the month or so before the outbreak was detected. It's also unknown whether the virus was mutating to be more lethal, or less.

Much Fear Mongering Being Promoted

I suspect you have likely been alarmed by the media's coverage of the swine flu scare. It has a noticeable subplot - preparing you for draconian measures to combat a future pandemic as well as forcing you to accept the idea of mandatory vaccinations.

On April 27, Time magazine published an article which discusses how dozens died and hundreds were injured from vaccines as a result of the 1976 swine flu fiasco, when the Ford administration attempted to use the infection of soldiers at Fort Dix as a pretext for a mass vaccination of the entire country.

Despite acknowledging that the 1976 farce was an example of “how not to handle a flu outbreak”, the article still introduces the notion that officials “may soon have to consider whether to institute draconian measures to combat the disease”.

WHO and CDC Pandemic Preparedness Seriously Broken

The pandemic warning system has failed as it simply doesn't exist, even in North America and Europe. To improve the system, massive new investments in surveillance, scientific and regulatory infrastructure, basic public health, and global access to common sense interventions like vitamin D optimization are required.

According to the Washington Post, the CDC did not learn about the outbreak until six days after Mexico had begun to impose emergency measures. There should be no excuses. The paradox of this swine flu panic is that, while totally unexpected, it was accurately predicted. Six years ago, Science dedicated a major story to evidence that "after years of stability, the North American swine flu virus has jumped onto an evolutionary fasttrack".

However, maybe this is precisely what public health authorities desire.

This is NOT the First Swine Flu Panic

My guess is that you can expect to see a lot of panic over this issue in the near future. But the key is to remain calm -- this isn't the first time the public has been warned about swine flu. The last time was in 1976, right before I entered medical school and I remember it very clearly. It resulted in the massive swine flu vaccine campaign.

Do you happen to recall the result of this massive campaign?

Within a few months, claims totaling $1.3 billion had been filed by victims who had suffered paralysis from the vaccine. The vaccine was also blamed for 25 deaths.

However, several hundred people developed crippling Guillain-Barré Syndrome after they were injected with the swine flu vaccine. Even healthy 20-year-olds ended up as paraplegics.

And the swine flu pandemic itself? It never materialized.

More People Died From the Swine Flu Vaccine than Swine Flu!

It is very difficult to forecast a pandemic, and a rash response can be extremely damaging.

As of Monday April 27, the worldwide total number of confirmed cases was 82, according to WHO, which included 40 cases in the U.S., confirmed by the Centers for Disease Control. But does that truly warrant the feverish news headlines?

To put things into perspective, malaria kills 3,000 people EVERY DAY, and it's considered "a health problem"... But of course, there are no fancy vaccines for malaria that can rake in billions of dollars in a short amount of time.

One Australian news source,3 for example, states that even a mild swine flu epidemic could lead to the deaths of 1.4 million people and would reduce economic growth by nearly $5 trillion dollars.

Give me a break, if this doesn't sound like the outlandish cries of the pandemic bird-flu I don't know what does. Do you remember when President Bush said two million Americans would die as a result of the bird flu?

In 2005, in 2006, 2007, and again in 2008, those fears were exposed as little more than a cruel hoax, designed to instill fear, and line the pocketbooks of various individuals and industry. I became so convinced by the evidence AGAINST the possibility of a bird flu pandemic that I wrote a New York Times bestselling book, The Bird Flu Hoax, all about the massive fraud involved with the epidemic that never happened..

swine fluWhat is the Swine Flu?

Regular swine flu is a contagious respiratory disease, caused by a type-A influenza virus that affects pigs. The current strain, A(H1N1), is a new variation of an H1N1 virus -- which causes seasonal flu outbreaks in humans -- that also contains genetic material of bird and pig versions of the flu.

Interestingly enough, this version has never before been seen in neither human nor animal, which I will discuss a bit later.

This does sound bad. But not so fast. There are a few reasons to not rush to conclusions that this is the deadly pandemic we've been told would occur in the near future (as if anyone could predict it without having some sort of inside knowledge).

Why a True Bird- or Swine Flu Pandemic is HIGHLY Unlikely

While in my opinion it is highly likely factory farming is responsible for producing this viral strain, I believe there is still no cause for concern.

You may not know this, but all H1N1 flu's are descendants of the 1918 pandemic strain. The reason why the flu shot may or may not work, however, from year to year, is due to mutations. Therefore, there's no vaccine available for this current hybrid flu strain, and naturally, this is feeding the fear that millions of people will die before a vaccine can be made.

However, let me remind you of one very important fact here.

Just a couple of months ago, scientists concluded that the 1918 flu pandemic that killed between 50-100 million people worldwide in a matter of 18 months -- which all these worst case scenarios are built upon -- was NOT due to the flu itself!4

Instead, they discovered the real culprit was strep infections.

People with influenza often get what is known as a "superinfection" with a bacterial agent. In 1918 it appears to have been Streptococcus pneumoniae.

Since strep is much easier to treat than the flu using modern medicine, a new pandemic would likely be much less dire than it was in the early 20th century, the researchers concluded.

Others, such as evolutionary biologist Paul Ewald,5 claim that a pandemic of this sort simply cannot happen, because in order for it to occur, the world has to change. Not the virus itself, but the world.

In a previous interview for Esquire magazine, in which he discusses the possibility of a bird flu pandemic, he states:

"They think that if a virus mutates, it's an evolutionary event. Well, the virus is mutating because that is what viruses and other pathogens do. But evolution is not just random mutation. It is random mutation coupled with natural selection; it is a battle for competitive advantage among different strains generated by random mutation.

For bird flu to evolve into a human pandemic, the strain that finds a home in humanity has to be a strain that is both highly virulent and highly transmissible. Deadliness has to translate somehow into popularity; H5N1 has to find a way to kill or immobilize its human hosts, and still find other hosts to infect. Usually that doesn't happen."

Ewald goes on to explain that evolution in general is all about trade-offs, and in the evolution of infections the trade-off is between virulence and transmissibility.

What this means is that in order for a "bird flu" or "swine flu" to turn into a human pandemic, it has to find an environment that favors both deadly virulence and ease of transmission.

People living in squalor on the Western Front at the end of World War I generated such an environment, from which the epidemic of 1918 could arise.

Likewise, crowded chicken farms, slaughterhouses, and jam-packed markets of eastern Asia provide another such environment, and that environment gave rise to the bird flu -- a pathogen that both kills and spreads, in birds, but not in humans.

Says Ewald:

"We know that H5N1 is well adapted to birds. We also know that it has a hard time becoming a virus that can move from person to person. It has a hard time without our doing anything. But we can make it harder. We can make sure it has no human population in which to evolve transmissibility. There is no need to rely on the mass extermination of chickens. There is no need to stockpile vaccines for everyone.

By vaccinating just the people most at risk -- the people who work with chickens and the caregivers -- we can prevent it from becoming transmissible among humans. Then it doesn't matter what it does in chickens."

Please remember that, despite the fantastic headlines and projections of MILLIONS of deaths, the H5N1 bird flu virus killed a mere 257 people worldwide since late 2003. As unfortunate as those deaths are, 257 deaths worldwide from any disease, over the course of five years, simply does not constitute an emergency worthy of much attention, let alone fear!

Honestly, your risk of being killed by a lightning strike in the last five years was about 2,300 percent higher than your risk of contracting and dying from the bird flu.6 I'm not kidding! In just one year (2004), more than 1,170 people died from lighting strikes, worldwide.7

So please, as the numbers of confirmed swine flu cases are released, keep a level head and don't let fear run away with your brains.

So is the Swine Flu Getting More or Less Dangerous?

On Sunday, April 26, The Independent reported that more than 1,000 people had contracted the swine flu virus in Mexico, 8 but by the afternoon that same day, Mexican President Calderon declared that more than two-thirds of the 1,300 thought to have contracted the disease had been given a clean bill of health and sent home.9

Additionally, the number of actual confirmed cases appears to be far lower than reported in many media outlets, leading me to believe that many reporters are interchanging the terms "suspected cases" and "confirmed cases."

Interestingly Mexico is the ONLY country in the world where someone has actually died from this disease.Mexico has reported 152 fatalities in flu-like cases in recent days, seven of which have been confirmed as swine flu. Another 19 patients have been confirmed as having swine flu but surviving. About 2,000 people have been hospitalized with symptoms.

By contrast, the United States has had 64 confirmed cases, five hospitalizations and no deaths from US Citizens. On April 29th CNN reported the first swine fatality in the US, however this was actually a child from Mexico that died in Texas.

According to the World Health Organization's Epidemic and Pandemic Alert and Response site; as of April 27, there are:

* 64 laboratory confirmed cases in U.S. -- 0 deaths (reported by CDC as of April 29)

* 26 confirmed cases in Mexico -- 7 deaths

* 6 confirmed cases in Canada -- 0 deaths

* 1 confirmed case in Spain -- 0 deaths

Additionally, nearly all suspected new cases have been reported as mild.

Personally, I am highly skeptical. It simply doesn't add up to a real pandemic.

But it does raise serious questions about where this brand new, never before seen virus came from, especially since it cannot be contracted from eating pork products, and has never before been seen in pigs, and contains traits from the bird flu -- and which, so far, only seems to respond to Tamiflu. Are we just that lucky, or... what?

Your Fear Will Make Some People VERY Rich in Today's Crumbling Economy

According to the Associated Press at least one financial analyst estimates up to $388 million worth of Tamiflu sales in the near future10 -- and that's without a pandemic outbreak.

More than half a dozen pharmaceutical companies, including Gilead Sciences Inc., Roche, GlaxoSmithKline and other companies with a stake in flu treatments and detection, have seen a rise in their shares in a matter of days, and will likely see revenue boosts if the swine flu outbreak continues to spread.

As soon as Homeland Security declared a health emergency, 25 percent -- about 12 million doses -- of Tamiflu and Relenza treatment courses were released from the nation's stockpile. However, beware that the declaration also allows unapproved tests and drugs to be administered to children. Many health- and government officials are more than willing to take that chance with your life, and the life of your child. But are you?

Remember, Tamiflu went through some rough times not too long ago, as the dangers of this drug came to light when, in 2007, the FDA finally began investigating some 1,800 adverse event reports related to the drug. Common side effects of Tamiflu include:

* Nausea

* Vomiting

* Diarrhea

* Headache

* Dizziness

* Fatigue

* Cough

All in all, the very symptoms you're trying to avoid.

More serious symptoms included convulsions, delirium or delusions, and 14 deaths in children and teens as a result of neuropsychiatric problems and brain infections (which led Japan to ban Tamiflu for children in 2007). And that's for a drug that, when used as directed, only reduces the duration of influenza symptoms by 1 to 1 ½ days, according to the official data.

But making matters worse, some patients with influenza are at HIGHER risk for secondary bacterial infections when on Tamiflu. And secondary bacterial infections, as I mentioned earlier, was likely the REAL cause of the mass fatalities during the 1918 pandemic!

Where did This Mysterious New Animal-Human Flu Strain Come From?

Alongside the fear-mongering headlines, I've also seen increasing numbers of reports questioning the true nature of this virus. And rightfully so.

Could a mixed animal-human mutant like this occur naturally? And if not, who made it, and how was it released?

Not one to dabble too deep in conspiracy theories, I don't have to strain very hard to find actual facts to support the notion that this may not be a natural mutation, and that those who stand to gain have the wherewithal to pull off such a stunt.

Just last month I reported on the story that the American pharmaceutical company Baxter was under investigation for distributing the deadly avian flu virus to 18 different countries as part of a seasonal flu vaccine shipment. Czech reporters were probing to see if it may have been part of a deliberate attempt to start a pandemic; as such a "mistake" would be virtually impossible under the security protocols of that virus.

The H5N1 virus on its own is not very airborne. However, when combined with seasonal flu viruses, which are more easily spread, the effect could be a potent, airborne, deadly, biological weapon. If this batch of live bird flu and seasonal flu viruses had reached the public, it could have resulted in dire consequences.

There is a name for this mixing of viruses; it's called "reassortment," and it is one of two ways pandemic viruses are created in the lab. Some scientists say the most recent global outbreak -- the 1977 Russian flu -- was started by a virus created and leaked from a laboratory.

Another example of the less sterling integrity of Big Pharma is the case of Bayer, who sold millions of dollars worth of an injectable blood-clotting medicine to Asian, Latin American, and some European countries in the mid-1980s, even though they knew it was tainted with the AIDS virus.

So while it is morally unthinkable that a drug company would knowingly contaminate flu vaccines with a deadly flu virus such as the bird- or swine flu, it is certainly not impossible. It has already happened more than once.

But there seems to be no repercussions or hard feelings when industry oversteps the boundaries of morality and integrity and enters the arena of obscenity. Because, lo and behold, which company has been chosen to head up efforts, along with WHO, to produce a vaccine against the Mexican swine flu?

Baxter!11 Despite the fact that ink has barely dried on the investigative reports from their should-be-criminal "mistake" against humanity.

According to other sources,12 a top scientist for the United Nations, who has examined the outbreak of the deadly Ebola virus in Africa, as well as HIV/AIDS victims, has concluded that the current swine flu virus possesses certain transmission "vectors" that suggest the new strain has been genetically-manufactured as a military biological warfare weapon.

The UN expert believes that Ebola, HIV/AIDS, and the current A-H1N1 swine flu virus are biological warfare agents.

In addition, Army criminal investigators are looking into the possibility that disease samples are missing from biolabs at Fort Detrick -- the same Army research lab from which the 2001 anthrax strain was released, according to a recent article in the Fredrick News Post.13 In February, the top biodefense lab halted all its research into Ebola, anthrax, plague, and other diseases known as "select agents," after they discovered virus samples that weren't listed in its inventory and might have been switched with something else.

Factory Farming Maybe Source of Swine Flu

Another theory as to the cause of Swine Flu might be factory farming. In the United States, pigs travel coast to coast. They can be bred in North Carolina, fattened in the corn belt of Iowa, and slaughtered in California.

While this may reduce short-term costs for the pork industry, the highly contagious nature of diseases like influenza (perhaps made further infectious by the stresses of transport) needs to be considered when calculating the true cost of long-distance live animal transport.

The majority of U.S. pig farms now confine more than 5,000 animals each. With a group of 5,000 animals, if a novel virus shows up it will have more opportunity to replicate and potentially spread than in a group of 100 pigs on a small farm.

With massive concentrations of farm animals within which to mutate, these new swine flu viruses in North America seem to be on an evolutionary fast track, jumping and reassorting between species at an unprecedented rate.

Should You Accept a Flu Vaccine -- Just to be Safe?

As stated in the New York Times14 and elsewhere, flu experts have no idea whether the current seasonal flu vaccine would offer any protection whatsoever against this exotic mutant, and it will take months to create a new one.

But let me tell you, getting vaccinated now would not only offer no protection and potentially cause great harm, it would most likely be loaded with toxic mercury which is used as a preservative in most flu vaccines..

I've written extensively about the numerous dangers (and ineffectiveness) of flu vaccines, and why I do not recommend them to anyone. So no matter what you hear -- even if it comes from your doctor -- don't get a regular flu shot. They rarely work against seasonal flu...and certainly can't offer protection against a never-before- seen strain.

Currently, the antiviral drugs Tamiflu and Relenza are the only drugs that appear effective against the (human flu) H1N1 virus, and I strongly believe taking Tamiflu to protect yourself against this new virus could be a serious mistake -- for all the reasons I already mentioned above.

But in addition to the dangerous side effects of Tamiflu, there is also growing evidence of resistance against the drug. In February, the pre-publication and preliminary findings journal called Nature Precedings published a paper on this concern, stating15:

The dramatic rise of oseltamivir [Tamiflu] resistance in the H1N1 serotype in the 2007/2008 season and the fixing of H274Y in the 2008/2009 season has raised concerns regarding individuals at risk for seasonal influenza, as well as development of similar resistance in the H5N1 serotype [bird flu].

Previously, oseltamivir resistance produced changes in H1N1 and H3N2 at multiple positions in treated patients. In contrast, the recently reported resistance involved patients who had not recently taken oseltamivir.

It's one more reason not to bother with this potentially dangerous drug.

And, once a specific swine flu drug is created, you can be sure that it has not had the time to be tested in clinical trials to determine safety and effectiveness, which puts us right back where I started this article -- with a potential repeat of the last dangerous swine flu vaccine, which destroyed the lives of hundreds of people.

Topping the whole mess off, of course, is the fact that if the new vaccine turns out to be a killer, the pharmaceutical companies responsible are immune from lawsuits -- something I've also warned about before on numerous occasions.

Unfortunately, those prospects won't stop the governments of the world from mandating the vaccine -- a scenario I hope we can all avoid.

How to Protect Yourself Without Dangerous Drugs and Vaccinations

For now, my point is that there are always going to be threats of flu pandemics, real or created, and there will always be potentially toxic vaccines that are peddled as the solution. But you can break free of that whole drug-solution trap by following some natural health principles.

I have not caught a flu in over two decades, and you can avoid it too, without getting vaccinated, by following these simple guidelines, which will keep your immune system in optimal working order so that you're far less likely to acquire the infection to begin with.

* Optimize your vitamin D levels. As I've previously reported, optimizing your vitamin D levels is one of the absolute best strategies for avoiding infections of ALL kinds, and vitamin D deficiency is likely the TRUE culprit behind the seasonality of the flu -- not the flu virus itself.

This is probably the single most important and least expensive action you can take. I would STRONGLY urge you to have your vitamin D level monitored to confirm your levels are therapeutic at 50-70 ng.ml and done by a reliable vitamin D lab like Lab Corp.

For those of you in the US we hope to launch a vitamin D testing service through Lab Corp that allows you to have your vitamin D levels checked at your local blood drawing facility, and relatively inexpensively. We hope to offer this service by June 2009.

If you are coming down with flu like symptoms and have not been on vitamin D you can take doses of 50,000 units a day for three days to treat the acute infection. Some researchers like Dr. Cannell, believe the dose could even be as high as 1000 units per pound of body weight for three days.

* Avoid Sugar and Processed Foods. Sugar decreases the function of your immune system almost immediately, and as you likely know, a strong immune system is key to fighting off viruses and other illness. Be aware that sugar is present in foods you may not suspect, like ketchup and fruit juice.

* Get Enough Rest. Just like it becomes harder for you to get your daily tasks done if you're tired, if your body is overly fatigued it will be harder for it to fight the flu. Be sure to check out my article Guide to a Good Night's Sleep for some great tips to help you get quality rest.

* Have Effective Tools to Address Stress . We all face some stress every day, but if stress becomes overwhelming then your body will be less able to fight off the flu and other illness.

If you feel that stress is taking a toll on your health, consider using an energy psychology tool such as the Emotional Freedom Technique (EFT), which is remarkably effective in relieving stress associated with all kinds of events, from work to family to trauma. You can check out my free, 25-page EFT manual for some guidelines on how to perform EFT.

* Exercise. When you exercise, you increase your circulation and your blood flow throughout your body. The components of your immune system are also better circulated, which means your immune system has a better chance of finding an illness before it spreads. You can review my exercise guidelines for some great tips on how to get started.

* Take a good source of animal based omega-3 fats like Krill Oil. Increase your intake of healthy and essential fats like the omega-3 found in krill oil, which is crucial for maintaining health. It is also vitally important to avoid damaged omega-6 oils that are trans fats and in processed foods as it will seriously damage your immune response.

* Wash Your Hands. Washing your hands will decrease your likelihood of spreading a virus to your nose, mouth or other people. Be sure you don't use antibacterial soap for this -- antibacterial soaps are completely unnecessary, and they cause far more harm than good. Instead, identify a simple chemical-free soap that you can switch your family to.

* Eat Garlic Regularly. Garlic works like a broad-spectrum antibiotic against bacteria, virus, and protozoa in the body. And unlike with antibiotics, no resistance can be built up so it is an absolutely safe product to use. However, if you are allergic or don't enjoy garlic it would be best to avoid as it will likely cause more harm than good.

* Avoid Hospitals and Vaccines In this particular case, I'd also recommend you stay away from hospitals unless you're having an emergency, as hospitals are prime breeding grounds for infections of all kinds, and could be one of the likeliest places you could be exposed to this new bug. Vaccines will not be available for six months at the minimum but when available they will be ineffective and can lead to crippling paralysis like Guillain-Barré Syndrome just as it did in the 70s.

Banking, Basel, Marks and Markets

Wed, 04/29/2009 - 01:28 — jamesBanking, Basel, Marks and Markets

Both the “mark to market” valuations for businesses set by FAS157 and the same effectivley for banks through Basel 11 which built on the original Basel accord, have set in place mechanisms which are prone to, and I believe designed to, the cascading effect. Looking at the effects of this or that regulation is a bit like trying to piece together what happened after a nuclear explosion by focusing on the cascading atomic reaction rather than on who designed and built this bloody bomb and who triggered it. In our case it is the bankers and their various regulatory bodies such as the Bank for International Settlements (BIS).

Here we have the industry looking at the cascading effect:-

Yeah well, Goodhart may well say, “what YOU (that's us, folks) really want...” but he could have added, “What WE really want (speaking for the bankers) is ever wilder cycles up and down.”

Cycles of boom and bust suit bankers. This can be determined rather simply because bankers are the ones who create this yo-yo cycle and it takes deliberate decisions on their part to do it. And they are the ones who profit from it every time. They do it by pumping the money supply up with lotsa loans and then deflating it and collecting lotsa cheap assets. This is the same mechanism behind the mysterious "business cycle". That some banks are going bust now does not mean that the bankers at the centre of control (BIS) are suffering. They're thinning out the competition.

When the Basel Accord was adopted by various governments, it took away control of banks by the host governments. Bank lending was no longer constrained by the government. The government in Australia, for instance, previously could regulate the lending of banks, in theory at least, (but in practice, the banks told the government what to do) independent of the market through Statutory Reserve Deposits i.e. it could go against the Market to damp it down. But now the banks would be regulated BY the market i.e go with it with no restraint now. “The Market” reigns supreme now but the market is and always has been subject to manipulation. And guess who is in the best position to manipulate it? Yes, our old friends the international bankers who own and control the major central banks of the world and their co-ordinating body, the BIS.

The Basel accord imposed on banks an overall set ratio of 8% capital to loans to non government bodies. But the ratio varied between loans for real estate (favoured), for instance, and commercial loans to industry (penalised by a higher ratio). The first thing that happened was that productive industry suffered and speculation in real estate and securities took off. Then these more speculative loans were onsold for a profit and this took them off their balance sheets which allowed the banks to lend more and more while still remaining within their capital ratio.

Meanwhile, they are making more and more profits from these activities plus, they are now price gouging through the imposition of all sorts of fees. This meant massive profits which then increased their capital which meant they could loan evermore money into the speculative sector. Banks were competing with each other for this largesse. Truly pigs at the trough. This self feeding cascading effect facilitated the long boom through the nineties till now, while all the while, industry is suffering and shrinking. The parasite is killing the host. But this situation can't keep going forever and eventually must slow and then the freefall starts. The system reverses itself. There's no mystery here. It was all predictable and therefore must be seen as deliberate on the part of the regulators who designed and brought this system in; the Bank for International Settlements and all the government officials who obliged in adopting it. Now the arguments start.

But arguing with bankers or investment people over regulations is a bit like arguing with a bunch of alcoholics, who have been left in charge of the liquor store, over the trading hours. The whole thing is nuts. One just should not be in this situation.

When I rule the world, these are the laws I will impose  !

!

1 The only body that will issue currency i.e. the money supply, is a government central bank.

2 Governments will only borrow from their own bank.

3 Private banks will be reduced to the status of Credit Co-ops or S&Ls in that they can only lend out funds what they have previously taken in as deposits.

4 No one will be able to on-sell a loan without incurring penalties (to discourage speculation) and with the specific permision of the borrower.

5 Short selling will be illegal in all markets, period. It is fraud to sell something you don't have or own. Future positions can be covered by put and call options or common insurance.

6 Foreign exchange can be handled internally via a government run market in which exporters are able to sell their well earned foreign currency to importers (who have to produce trade contracts to validate their need for it) and the price is set by normal market supply and demand. No foreign debt can be accululated in this fashion and foreign trade does not imbalance the domestic market; it's self regulating. This system was first proposed by John Iggulden of Australia some years ago. He called it Impex. And it's nothing short of brilliant in it's simplicity and elegance.

7 All financial markets will be subjected to a turnover tax to raise taxes from those that can afford them and to discourage speculation. Currently, close to 98% of turnover in foreign exchange markets is speculation and has nothing to do with foreign trade. Our economies are being run by gamblers. And addicted gamblers, at that.

8 The money earned from financial market turnover and interest gained from creating the money supply would go a long way, if not all the way, to providing the government's revenue requirements.

All pretty simple.

The whole financial industry as it is, this bloated, blind and toxic parasite, should be as welcome as a turd in a swimming pool in any decent, just and well run society.

What Cooked The World's Economy?

Tue, 04/28/2009 - 23:27 — AnonymousTuesday 27 January 2009

by: James Lieber | Visit article original @ The Village Voice

Financial news streams across NASDAQ's studio on Times Square in New York. (Photo: Q. Sakamaki / Redux)

It wasn't your overdue mortgage.

It's 2009. You're laid off, furloughed, foreclosed on, or you know someone who is. You wonder where you'll fit into the grim new semi-socialistic post-post-industrial economy colloquially known as "this mess."

You're astonished and possibly ashamed that mutant financial instruments dreamed up in your great country have spawned worldwide misery. You can't comprehend, much less trim, the amount of bailout money parachuting into the laps of incompetents, hoarders, and miscreants. It's been a tough century so far: 9/11, Iraq, and now this. At least we have a bright new president. He'll give you a job painting a bridge. You may need it to keep body and soul together.

The basic story line so far is that we are all to blame, including homeowners who bit off more than they could chew, lenders who wrote absurd adjustable-rate mortgages, and greedy investment bankers.

Credit derivatives also figure heavily in the plot. Apologists say that these became so complicated that even Wall Street couldn't understand them and that they created "an unacceptable level of risk." Then these blowhards tell us that the bailout will pump hundreds of billions of dollars into the credit arteries and save the patient, which is the world's financial system. It will take time - maybe a year or so - but if everyone hangs in there, we'll be all right. No structural damage has been done, and all's well that ends well.

Sorry, but that's drivel. In fact, what we are living through is the worst financial scandal in history. It dwarfs 1929, Ponzi's scheme, Teapot Dome, the South Sea Bubble, tulip bulbs, you name it. Bernie Madoff? He's peanuts.

Credit derivatives - those securities that few have ever seen - are one reason why this crisis is so different from 1929.

Derivatives weren't initially evil. They began as insurance policies on large loans. A bank that wished to lend money to a big, but shaky, venture, like what Ford or GM have become, could hedge its bet by buying a credit derivative to cover losses if the debtor defaulted. Derivatives weren't cheap, but in the era of globalization and declining American competitiveness, they were prudent. Interestingly, the company that put the basic hardware and software together for pricing and clearing derivatives was Bloomberg. It was quite expensive for a financial institution - say, a bank - to get a Bloomberg machine and receive the specialized training required to certify analysts who would figure out the terms of the insurance. These Bloomberg terminals, originally called Market Masters, were first installed at Merrill Lynch in the late 1980s.

Subsequently, thousands of units have been placed in trading and financial institutions; they became the cornerstone of Michael Bloomberg's wealth, marrying his skills as a securities trader and an electrical engineer.

It's an open question when or if he or his company knew how they would be misused over time to devastate the world's economy.

:::::::::::::::::::::::::::::::::::::::::::::::::

Fast-forward to the early years of the Clinton administration. After an initial surge of regulatory behavior in favor of fair markets, especially in antitrust, that sort of behavior was abandoned, and free markets triumphed. The result was a morass of white-collar sociopathy at Archer Daniels Midland, Enron, and WorldCom, and in a host of markets ranging from oil to vitamins.

This was the beginning of the heyday of hedge funds. Unregulated investment houses were originally based on the questionable but legal practice of short-selling - selling a financial instrument you don't own in hopes of buying it back later at a lower price. That way, you hedge your bets: You cover your investment in a company in case a company's stock price falls.

But hedge funds later diversified their practices beyond that easy definition. These funds acquired a good deal of popular mystique. They made scads of money. Their notoriously high entry fees - up to 5 percent of the investment, plus as much as 36 percent of profits - served as barriers to all but the richest investors, who gave fortunes to the funds to play with. The funds boasted of having genius analysts and fabulous proprietary algorithms. Few could discern what they really did, but the returns, for those who could buy in, often seemed magical.

But it wasn't magic. It amounted to the return of the age-old scam called "bucket shops." Also sometimes known as "boiler rooms," bucket shops emerged after the Civil War. Usually, they were storefronts where people came to bet on stocks without owning them. Unlike their customers, the shops actually owned blocks of stock. If customers were betting that a stock would go up, the shops would sell it and the price would plunge; if bettors were bearish, the shops would buy. In this way, they cleaned out their customers. Frenetic bucket-shop activity caused the Panic of 1907. By 1909, New York had banned bucket shops, and every other state soon followed.

In the mid-'90s, though, the credit-derivatives industry was hitting its stride and argued vehemently for exclusion from all state and federal anti-bucket-shop regulations. On the side of the industry were Federal Reserve Chairman Alan Greenspan, Treasury Secretary Robert Rubin, and his deputy, Lawrence Summers. Holding the fort for the regulators was Brooksley Born, who headed the Commodity Futures Trading Commission (CFTC). The three financial titans ridiculed the virtually unknown and cloutless, but brilliant and prophetic Born, who warned that unrestricted derivatives trading would "threaten our regulated markets, or indeed, our economy, without any federal agency knowing about it." Warren Buffett also weighed in against deregulation.

But Congress loved Greenspan - a/k/a "the Maestro" and "the Oracle" - and Clinton loved Rubin. The sleepy hearings received almost no public attention. The upshot was that Congress removed oversight of derivatives from the CFTC and preempted all state anti-bucket-shop laws. Born resigned shortly afterward.

Soon, something odd started to happen. Legitimate big investors, often with millions of dollars to place, found that they couldn't get into certain hedge funds, despite the fact that they were willing to pay steep fees. In retrospect, it seems as if these funds did not want fussy outsiders looking into what they were doing with derivatives.

:::::::::::::::::::::::::::::::::::::::::::::::::

Imagine that a person is terminally ill. He or she would not be able to buy a life insurance policy with a huge death benefit. Obviously, third parties could not purchase policies on the soon-to-be-dead person's life. Yet something like that occurred in the financial world.

This was not caused by imprudent mortgage lending, though that was a piece of the puzzle. Yes, Fannie Mae and Freddie Mac were put on steroids during the '90s, and some people got into mortgages who shouldn't have. But the vast majority of homeowners paid their mortgages. Only about 5 to 10 percent of these loans failed - not enough to cause systemic financial failure. (The dollar amount of defaulted mortgages in the U.S. is about $1.2 trillion, which seems like a princely sum, but it's not nearly enough to drag down the entire civilized world.)

Much more dangerous was the notorious bundling of mortgages. Investment banks gathered these loans into batches and turned them into securities called collateralized debt obligations (CDOs). Many included high-risk loans. These securities were then rated by Standard & Poor's, Fitch Ratings, or Moody's Investors Services, who were paid at premium rates and gave investment grades. This was like putting lipstick on pigs with the plague. Banks like Wachovia, National City, Washington Mutual, and Lehman Brothers loaded up on this financial trash, which soon proved to be practically worthless. Today, those banks are extinct. But even that was not enough to cause a worldwide financial crisis.

What did cause the crisis was the writing of credit derivatives. In theory, they were insurance policies for investors; in practice, they became a guarantee of global financial collapse.

As insurance, they were poised to pay off fabulously when these weak bundled securities failed. And who was waiting to collect? Well, every gambler is looking for a sure bet. Most never find it. But the hedge funds and their ilk did.

:::::::::::::::::::::::::::::::::::::::::::::::::

The mantra of entrepreneurial culture is that high risk goes with high reward. But unregulated and opaque derivatives trading was countercultural in the sense that low or no risk led to quick, astronomically high rewards. By plunking down millions of dollars, a hedge fund could reap billions once these fatally constructed securities plunged. Again, the funds did not need to own the securities; they just needed to pay for the derivatives - the insurance policies for the securities. And they could pay for them again and again. This was known as replicating. It became an addiction.

About $2 trillion in credit derivatives in 1989 jumped to $8 trillion in 1994 and skyrocketed to $100 trillion in 2002. Last year, the Bank for International Settlements, a consortium of the world's central banks based in Basel (the Fed chair, Ben Bernanke, sits on its board), reported the gross value of these commitments at $596 trillion. Some are due, and some will mature soon. Typically, they involve contracts of five years or less.

Credit derivatives are breaking and will continue to break the world's financial system and cause an unending crisis of liquidity and gummed-up credit. Warren Buffett branded derivatives the "financial weapons of mass destruction." Felix Rohatyn, the investment banker who organized the bailout of New York a generation ago, called them "financial hydrogen bombs."

Both are right. At almost $600 trillion, over-the-counter (OTC) derivatives dwarf the value of publicly traded equities on world exchanges, which totaled $62.5 trillion in the fall of 2007 and fell to $36.6 trillion a year later.

The nice thing about public markets is that they act as canaries that give warnings as they did in 1929, 1987 (the program trading debacle), and 2001 (the dot-com bubble), so we can scramble out with our economic lives. But completely private and unregulated, the OTC derivatives trade is justly known as the "dark market."

:::::::::::::::::::::::::::::::::::::::::::::::::

The heart of darkness was the AIG Financial Products (AIGFP) office in London, where a large proportion of the derivatives were written. AIG had placed this unit outside American borders, which meant that it would not have to abide by American insurance reserve requirements. In other words, the derivatives clerks in London could sell as many products as they could write - even if it would bankrupt the company.

The president of AIGFP, a tyrannical super-salesman named Joseph Cassano, certainly had the experience. In the 1980s, he was an executive at Drexel Burnham Lambert, the now-defunct brokerage that became the pivot of the junk-bond scandal that led to the jailing of Michael Milken, David Levine, and Ivan Boesky.

During the peak years of derivatives trading, the 400 or so employees of the London unit reportedly averaged earnings in excess of a million dollars a year. They sold "protection" - this Runyonesque term was favored - worth more than three times the value of parent company AIG. How could they have not known that they were putting at risk the largest insurer in the world and all the businesses and individuals that it covered?

This scheme that smacks of securities fraud facilitated the dreams of buyers called "counterparties" willing to ante up. Hedge fund offices sprouted in Kensington and Mayfair like mushrooms after a summer shower. Revenue from premiums for derivatives at AIGFP rose from $737 million in 1999 to $3.26 billion in 2005. Cassano reportedly hectored ever-willing counterparties to "play the power game" - in other words, gobble up all the credit derivatives backing CDOs that they could grab. As the bundled adjustable-rate mortgages ballooned, stretched home buyers defaulted, and the exciting power game became about as risky as blasting sitting ducks with a Glock.

People still seem surprised to read that hedge principals have raked in billions of dollars in a single year. They shouldn't be. These subprime-time players knew how to score. The scam bled AIG white. In mid-September, when it was on the ropes, AIG received an astonishing $85 billion emergency line of credit from the Fed. Soon, that was supplemented by another $67 billion. Much of that money, to use the government's euphemism, has already been "drawn down." Shamefully, neither Washington nor AIG will explain where the billions went. But the answer is increasingly clear: It went to counterparties who bought derivatives from Cassano's shop in London.

:::::::::::::::::::::::::::::::::::::::::::::::::

Imagine if a ring of cashiers at a local bank made thousands of bad loans, aware that they could break the bank. They would be prosecuted for fraud and racketeering under the anti-gangster RICO Act. If their counterparties - the debtors - were in on the scam and understood that they didn't have to pay off the loans, they could be charged, too. In fact, this scenario played out at subprime-pushing outlets of a host of banks, including Washington Mutual (acquired last year by JP Morgan Chase, which itself received a $25 billion bailout); IndyMac (which was seized by FDIC regulators); and Lehman Brothers (which went belly-up). About 150 prosecutions of this type of fraud are going forward.

The top of the swamp's food chain, where the muck was derivatives rather than mortgages, must also be scrutinized. Apparently, that is the case. AIGFP's Cassano has hired top white-collar litigator and former prosecutor F. Joseph Warin (profiled in the 2004 Washingtonian piece, "Who to Call When You're Under Investigation!"). Neither Cassano nor his attorney responded to interview requests.

AIG's lavishly compensated counterparties were willing participants and likewise could be considered for prosecution, depending on what they knew. Who were they?

At a 2007 conference, Cassano defined them as a "global swath" that included "banks and investment banks, pension funds, endowments, foundations, insurance companies, hedge funds, money managers, high-net-worth individuals, municipalities, sovereigns, and supranationals." Abetting the scheme, ratings agencies like Standard & Poor's gave high grades to the shaky mortgage-backed securities bundled by investment banks such as Goldman Sachs and Lehman Brothers.

After the relative worthlessness of these CDOs became clear, the raters rushed to downgrade them to junk status. This occurred suddenly with more than 4,000 CDOs in the first quarter of 2008 - the financial community now regards them as "toxic waste." Of course, the sudden massive downgrading raises the question: Why had CDOs been artificially elevated in the first place, leading banks to buy them and giving them protective coloring just because the derivatives writers "insured" them?

After the raters got real (i.e., got scared), the gig was up. Hedge funds fled in droves from their luxe digs in London. The industry remains murky, but some observers feel that more than half of all hedges will fold this year. Not necessarily a good sign, it seems to show that the funds were one-trick ponies living mainly off the derivatives play.

We know that AIG was not the only firm that sold derivatives: Lehman and Bear Stearns both dealt them and died. About 20 years ago, JP Morgan, the now-defunct investment bank, had brought the idea to AIGFP in London, which ran with it. Seeing the Cassano group's success, Morgan jumped in with both feet. Specializing in credit default swaps - a type of derivative triggered to pay off by negative events in the lives of loans, like defaults, foreclosures, and restructurings - Morgan had a distinctive marketing spin. Its "quants" were classy young dealers who could really do the math, which of course gave them credibility with those who couldn't. They abjured street slang like "protection." They pitched their sophisticated swaps as "technologies." The market adored them. They, in turn, oversold the product, made huge commissions, and wounded Morgan, which had to sell itself to Chase, becoming JP Morgan Chase - now the country's biggest bank.

Today, the real question is whether the Morgan quants knew the swaps didn't work and actually were grenades with pulled pins. Like Joseph Cassano, such people should consult attorneys.

:::::::::::::::::::::::::::::::::::::::::::::::::

Secrecy shrouds the bailout. The 21 banks that each received more than $1 billion from the Fed won't disclose how, or even if, they're lending it, which hardly quells fears of hoarding. The Treasury says it can't force disclosure because it took only preferred (non-voting) stock in exchange for the money.

If anything, the Fed had been less candid. It stonewalls requests to reveal the winners (mainly banks and corporations) of $1.5 trillion in loans, as well as the securities it received as collateral. A Freedom of Information Act (FOIA) suit to obtain this information by Bloomberg News has been rebuffed by the Fed, which insists that a loophole in FOIA exempts it. Bloomberg will probably lose the case, but at least it's trying to probe the black hole of bailout money. Of course, Barack Obama could tell the Fed to release the information, plus generally open the bailout to public eyes. That would be change that we could believe in.

As for Bloomberg, its business side, Bloomberg L.P., has been less than forthcoming. Requests to interview someone from the company - and Michael Bloomberg, who retains a controlling interest - about the derivatives trade went unanswered.

In his economic address at Cooper Union last spring, Obama argued for new regulations, which he called "the rules of the road," and for a $30 billion stimulus package, that now seems quaint. In the OTC swaps trade, the Bloomberg L.P.'s computer terminals are the road, bridges, and tunnels for "real-time" transactions. The L.P.'s promotional materials declare: "You're either in front of a Bloomberg or behind it." In terms of electronic trading of certain securities, including credit default swaps: "Access to a dealer's inventory is based upon client relationships with Bloomberg as the only conduit." In short, the L.P. looks like a dominant player - possibly, a monopoly. If it has a true competitor, I can't find it. But then, this is a very dark market.

Did Bloomberg L.P. do anything illegal? Absolutely not. We prosecute hit-and-run drivers, not roads. But there are many questions - about the size of the derivatives market, the names of the counterparties, the amount of replication of derivatives, the role of securities ratings in Bloomberg calculations (in other words, could puffing up be detected and potentially stop a swap?), and how the OTC industry should be reported and regulated in order to prevent future catastrophes. Bloomberg is a privately held company - to the chagrin of would-be investors - and quite private about its business, so this information probably won't surface without subpoenas.

:::::::::::::::::::::::::::::::::::::::::::::::::

So what do we do now? In 2000, the 106th Congress as its final effort passed the Commodity Futures Modernization Act (CFMA), and, disgracefully, President Clinton signed it. It opened up the bucket-shop loophole that capsized the world's economic system. With the stroke of a presidential pen, a century of valuable protection was lost.

Even with that, the dangerous swaps still almost found themselves subjected to state oversight. In 2000, AIG asked the New York State Insurance Department to decide if it wanted to regulate them, but the department's superintendent, Neil Levin, said no. The question was not posed by AIGFP, but by the company's main office through its general counsel, a reminder that not long ago, AIG was a blue chip with a triple-A rating that touted its integrity.

We can't know why Levin rejected the chance to regulate the tricky trade. He died in the restaurant at the top of the World Trade Center on the morning of 9/11. A Pataki-appointed former Goldman Sachs vice president, Levin may have shared other Wall Streeters' love of derivatives as the last big-money sure thing as the IPO craze wound down. Or maybe he saw swaps as gambling rather than insurance, hence beyond his jurisdiction. Regardless, current Insurance Superintendent Eric Dinallo told me, "I don't agree with his answer." Maybe the economic crisis could have been averted if Levin had answered otherwise. "How close we came ..." Dinallo mused.

Deeply occupied with keeping AIG, the parent company, afloat since the bailout, Dinallo saw the carnage that the swaps caused and, with the support of Governor Paterson, pushed anew for regulatory oversight, a position also adopted by the President's Working Group (PWG), which includes the Treasury, Fed, SEC, and CFTC.

But regulation isn't enough to stop a phenomenon called "de-supervision" that occurs when officials can't, or won't, oversee a market. For instance, the Fed under Greenspan had authority to regulate mortgage bankers and brokers, the industry's cowboys who kicked off this fiasco. Because Greenspan's libertarian sensibilities prevented him from invoking the Fed's control, the mortgage market careened corruptly until the wheels came off. Notoriously lax and understaffed, the SEC did nothing to limit investment banks that bundled, pitched, and puffed non-prime mortgages as the raters cheered. It's doubtful that any agency can be relied on to control lucrative default swaps, which should be made illegal again. The bucket-shop loophole must be closed. The evil genie should go back in the bottle.

Will Obama re-criminalize these financial weapons by pushing for repeal of the CFMA? This should be a no-brainer for Obama, who, before becoming a community organizer in Chicago, worked on Wall Street, studied derivatives, and by now undoubtedly knows their destructive power.

What about the $600 trillion in credit derivatives that are still out there, sucking vital liquidity and credit out of the system? It's the tyrannosaurus in the mall, the one that made Henry Paulson, the former Treasury Secretary who looks like Daddy Warbucks, get down on his knees and beg Nancy Pelosi for a bailout.

Even with the bailout, no one can get their arms around this monster. Obviously, the $600 trillion includes not only many unseemly replicated death bets, but also some benign derivatives that creditors bought to hedge risky loans. Instead of sorting them out, the Bush administration tried to protect them all, while keeping the counterparties happy and anonymous.

Paulson has taken flack for spending little to bring mortgages in line with falling home values. Sheila Bair, the FDIC chief who often scrapped with Paulson, said this would cost a measly $25 billion and that without it, 10 million Americans could lose their homes over the next five years. Paulson thought it would take three times as much and balked. Congress is bristling because the Emergency Economic Stabilization Act (EESA) could provide mortgage relief - and some derivatives won't detonate if homeowners don't default. Obama's nominee for Treasury Secretary, Timothy Geithner, could back such relief at his hearings.

The other key appointment is attorney general. A century ago, when powerful trusts distorted the market system, we had AGs who relentlessly tracked and busted them. Today's crisis is missing, so far, an advocate as dynamic and energetic as the mortgage bankers, brokers, bundlers, raters, and quants who, in a few short years, littered the world with rotten loans, diseased CDOs, and lethal derivatives. During the Bush years, white-collar law enforcement actually dropped as FBI agents were transferred to antiterrorism. Even so, according to William Black, an effective federal litigator and regulator during the 1980s savings-and-loan scandal, by 2004, the FBI perceived an epidemic of fraud. Now a professor of law and finance at the University of Missouri-Kansas City, Black has testified to Congress about the current crisis and paints it as "control fraud" at every level. Such fraud flows from the top tiers of corporations - typically CEOs and CFOs, who control perverse compensation systems that reward cheating and volume rather than quality, and circumvent standard due diligence such as underwriting and accounting. For instance, AIGFP's Cassano reportedly rebuffed AIG's internal auditor.

The environment from the top of the chain - derivatives gang leaders - to the bottom of the chain - subprime, no-doc loan officers - became "criminogenic," Black says. The only real response? Aggressive prosecution of "elites" at all stages in this twisted mess. Black says sentences should not be the light, six-month slaps that white-collar criminals usually get, or the Madoff-style penthouse arrest.

As staggering as the Madoff meltdown was, it had a refreshing side - the funds were frozen. In the bailout, on the other hand, the government often seems to be completing the scam by quietly passing the proceeds to counterparties.

The advantage of treating these players like racketeers under federal law is that their ill-gotten gains could be forfeited. The government could recoup these odious gambling debts instead of simply paying them off. In finance, the bottom line is the bottom line. The bottom line in this scandal is that fantastically wealthy entities positioned themselves to make unfathomable fortunes by betting that average Americans - Joe Six-Packs and hockey moms - would fail.

Black suggests that derivatives should be "unwound" and that the payouts cease: "Close out the positions - most of them have no social utility." And where there has been fraud, he adds, "clawback makes perfect sense." That would include taking back the ludicrously large bonuses and other forms of compensation given to CEOs at bailed-out companies.

No one knows how much could be clawed back from the soiled derivatives reap. Clearly, it's not $600 trillion. William Bergman, formerly a market analyst at the Chicago Fed in "netting" - what's left after financial institutions pay each other off for ongoing deals and debts - makes a "guess" that perhaps only 5 percent could be recouped, which he concedes is unfortunately low. Still, that's $30 trillion, a huge number, more than 10 times what the Fed can deploy and over twice the U.S. gross domestic product. Such a sum, if recovered through the criminal justice process, could ease the liquidity crisis and actually get the credit arteries flowing. Not everyone would like it. What's left of Wall Street and hedge funds want their derivatives gains; so do foreign banks.

:::::::::::::::::::::::::::::::::::::::::::::::::

A tangle of secrecy, conflicts of interest, and favoritism plagues the process of recovery.

Lehman drowned, but Goldman Sachs, where Paulson was formerly CEO, was saved. The day before AIG reaped its initial $85 billion bonanza, Paulson met with his successor, Lloyd Blankfein, who reportedly argued that Goldman would lose $20 billion and fail unless AIG was rescued. AIG got the money.

Had Goldman bought from AIG credit derivatives that it needed to redeem? Like most other huge financial traders, Goldman has a secretive hedge fund, Global Alpha, that refuses to reveal its transactions. Regardless, Paulson's meeting with Blankfein was a low point. If Dick Cheney had met with his successor at Halliburton and, the very next day, written a check for billions that guaranteed its survival, the press would have screamed for his head.

The second most shifty bailout went to Citigroup, a money sewer that won last year's layoff super bowl with 73,000. Instead of being parceled to efficient operators, Citi received a $45 billion bailout and $300 billion loan package, at least in part because of Robert Rubin's juice. While Treasury Secretary under Clinton, Rubin led us into the derivatives maelstrom, deported jobs with NAFTA, and championed bank deregulation so that companies like Citi could mimic Wall Street speculators. After he joined Citi's leadership in 1999, the bank went long on mortgages and other risks du jour, enmeshed itself in Enron's web, tanked in value, and suffered haphazard management, while Rubin made more than $100 million.

Rubin remained a director and "senior counselor" at Citi until January 9, 2009, and is an economic adviser to Obama. In truth, he probably shouldn't be a senior counselor anywhere except possibly at Camp Granada. Like Greenspan, he should retire before he breaks something again, and we have to pay for it. (Incidentally, the British bailout, which is more open than ours and mandates mortgage relief, makes corporate welfare contingent on the removal of bad management.)

The third strangest rescue involved the Fed's announcement just before Christmas that hedge funds for the first time could borrow from it. Apparently, the new $200 billion credit line relates to recently revealed securitized debts including bundled credit card bills, student loans, and auto loans. Obviously, it's worrisome that the crisis may be morphing beyond its real estate roots.

:::::::::::::::::::::::::::::::::::::::::::::::::

To say the bailout hasn't worked so far is putting it mildly. Since the crisis broke, Washington's reaction has been chaotic, lenient to favorites, secretive, and staggeringly expensive. An estimated $7.36 trillion, more than double the total American outlay for World War II (even correcting for inflation), has been thrown at the problem, according to press reports. Along the way, banking, insurance, and car companies have been nationalized, and no one has been brought to justice.

Combined unemployment and underemployment (those who have stopped looking, and part-timers) runs at nearly 20 percent, the highest since 1945. Housing prices continue to hemorrhage - last fall's 18 percent drop could double. Holiday shopping fizzled: 160,000 stores closed last year, and 200,000 more are expected to shutter in '09. Some forecasts place eventual retail darkness at 25 percent. In 2008, the Dow dropped further - 34 percent - than at any time since 1931. There is no sound sector in the economy; the only members of the 30 Dow Jones Industrials posting gains last year were Wal-Mart and McDonald's.